Summary

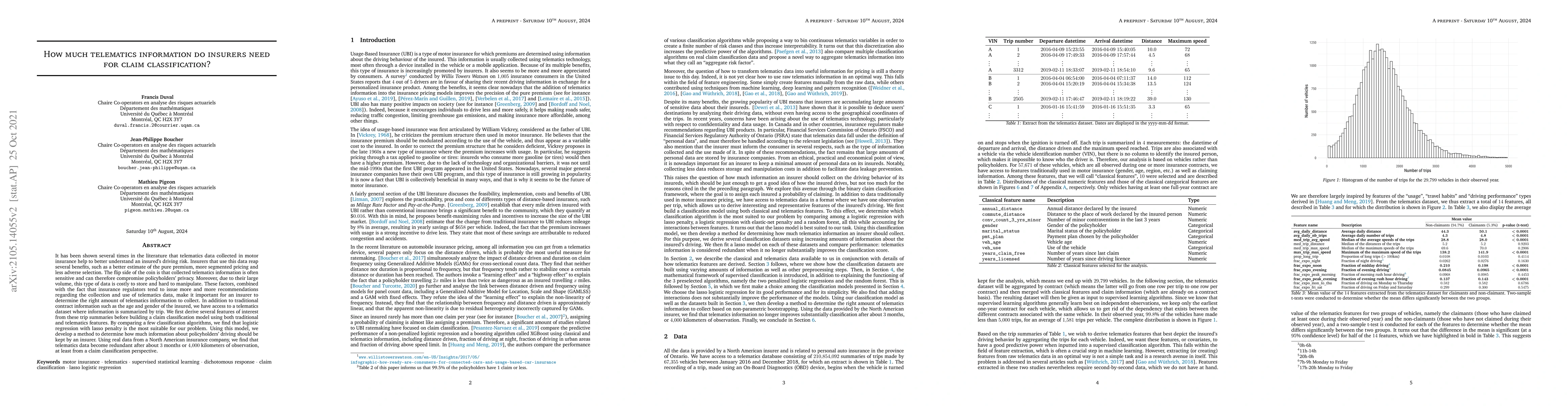

It has been shown several times in the literature that telematics data collected in motor insurance help to better understand an insured's driving risk. Insurers that use this data reap several benefits, such as a better estimate of the pure premium, more segmented pricing and less adverse selection. The flip side of the coin is that collected telematics information is often sensitive and can therefore compromise policyholders' privacy. Moreover, due to their large volume, this type of data is costly to store and hard to manipulate. These factors, combined with the fact that insurance regulators tend to issue more and more recommendations regarding the collection and use of telematics data, make it important for an insurer to determine the right amount of telematics information to collect. In addition to traditional contract information such as the age and gender of the insured, we have access to a telematics dataset where information is summarized by trip. We first derive several features of interest from these trip summaries before building a claim classification model using both traditional and telematics features. By comparing a few classification algorithms, we find that logistic regression with lasso penalty is the most suitable for our problem. Using this model, we develop a method to determine how much information about policyholders' driving should be kept by an insurer. Using real data from a North American insurance company, we find that telematics data become redundant after about 3 months or 4,000 kilometers of observation, at least from a claim classification perspective.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)