Summary

This paper proposes two approaches that quantify the exact relationship among the viability, the absence of arbitrage, and/or the existence of the num\'eraire portfolio under minimal assumptions and for general continuous-time market models. Precisely, our first and principal contribution proves the equivalence among the No-Unbounded-Profit-with-Bounded-Risk condition (NUPBR hereafter), the existence of the num\'eraire portfolio, and the existence of the optimal portfolio under an equivalent probability measure for any "nice" utility and positive initial capital. Herein, a 'nice" utility is any smooth von Neumann-Morgenstern utility satisfying Inada's conditions and the elasticity assumptions of Kramkov and Schachermayer. Furthermore, the equivalent probability measure ---under which the utility maximization problems have solutions--- can be chosen as close to the real-world probability measure as we want (but might not be equal). Without changing the underlying probability measure and under mild assumptions, our second contribution proves that the NUPBR is equivalent to the "{\it local}" existence of the optimal portfolio. This constitutes an alternative to the first contribution, if one insists on working under the real-world probability. These two contributions lead naturally to new types of viability that we call weak and local viabilities.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper proposes two approaches to quantify the relationship among viability, absence of arbitrage, and the existence of a numéraire portfolio under minimal assumptions for general continuous-time market models.

Key Results

- The equivalence among the No-Unbounded-Profit-with-Bounded-Risk (NUPBR) condition, the existence of a numéraire portfolio, and the existence of an optimal portfolio under an equivalent probability measure is proven for any 'nice' utility and positive initial capital.

- The equivalent probability measure can be chosen arbitrarily close to the real-world probability measure without changing the underlying probability measure.

- The NUPBR condition is shown to be equivalent to the local existence of the optimal portfolio under the real-world probability measure.

- New types of viability, called weak and local viabilities, are introduced as a result of these findings.

Significance

This research contributes to the understanding of the fundamental relationships in financial market models, providing a more nuanced view of arbitrage-free conditions and the existence of numéraire portfolios, which is crucial for pricing and risk management in finance.

Technical Contribution

The paper establishes equivalences between NUPBR, the existence of a numéraire portfolio, and the optimal portfolio under equivalent probability measures, extending previous work by providing alternative conditions under the real-world probability measure.

Novelty

The novelty lies in demonstrating the equivalence of NUPBR with both the global and local existence of an optimal portfolio, and in introducing new types of viability concepts that capture more subtle market behaviors.

Limitations

- The paper focuses on continuous-time models and does not explicitly address discrete-time models.

- The assumptions made about 'nice' utilities may limit the direct applicability to some practical financial utility functions.

Future Work

- Further exploration of the implications of these findings in discrete-time models.

- Investigating the practical relevance and applicability of 'weak' and 'local' viability concepts in real financial markets.

Paper Details

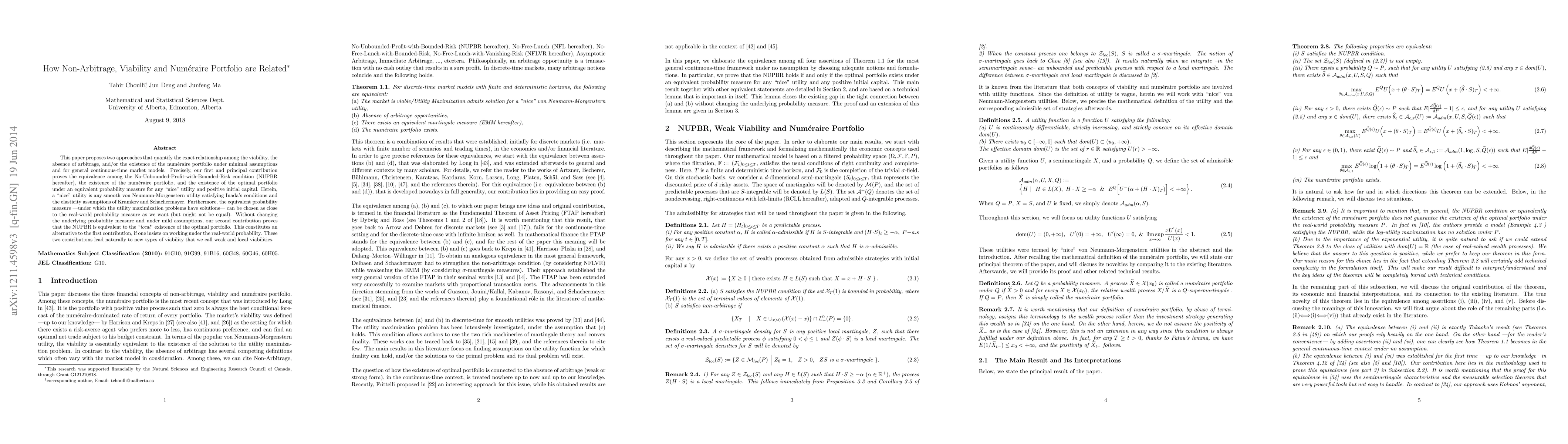

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)