Summary

This paper focuses on num\'eraire portfolio and log-optimal portfolio (portfolio with finite expected utility that maximizes the expected logarithm utility from terminal wealth), when a market model $(S,\mathbb F)$ -specified by its assets' price $S$ and its flow of information $\mathbb F$- is stopped at a random time $\tau$. This setting covers the areas of credit risk and life insurance, where $\tau$ represents the default time and the death time respectively. Thus, the progressive enlargement of $\mathbb F$ with $\tau$, denoted by $\mathbb G$, sounds tailor-fit for modelling the new flow of information that incorporates both $\mathbb F$ and $\tau$. For the resulting stopped model $(S^{\tau},\mathbb G)$, we study the two portfolios in different manners, and describe their computations in terms of the $\mathbb F$-observable parameters of the pair $(S, \tau)$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

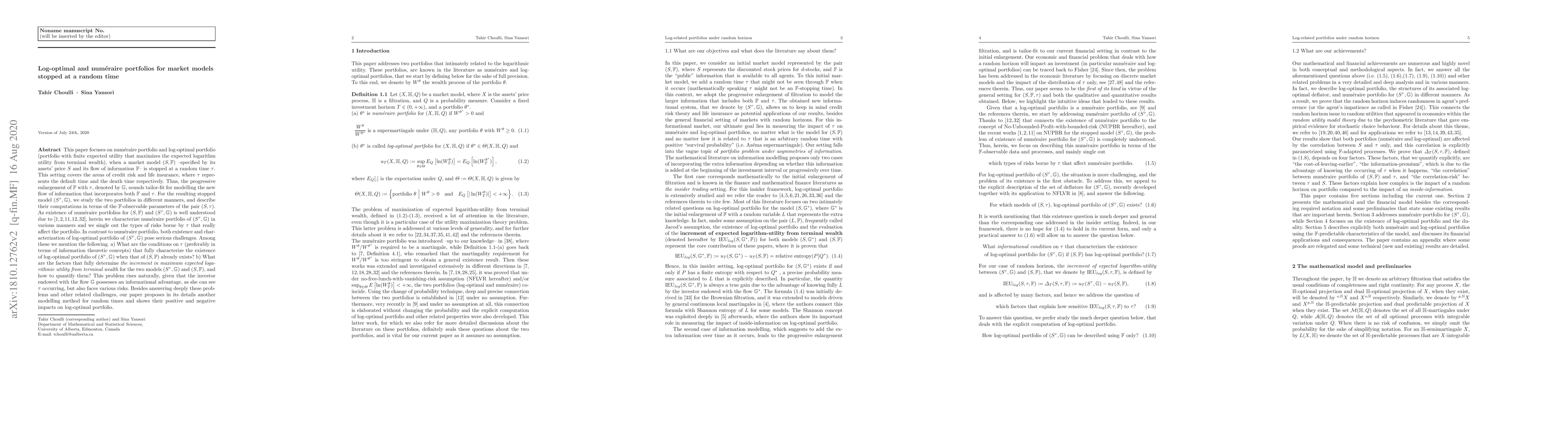

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLog-optimal portfolio after a random time: Existence, description and sensitivity analysis

Tahir Choulli, Ferdoos Alharbi

| Title | Authors | Year | Actions |

|---|

Comments (0)