Authors

Summary

In this paper, we consider an informational market model with two flows of informations. The smallest flow F, which is available to all agents, is the filtration of the initial market model(S,F,P), where S is the assets' prices and P is a probability measure. The largest flow G contains additional information about the occurrence of a random time T. This setting covers credit risk theory where T models the default time of a firm, and life insurance where T represents the death time of an insured. For the model (S-S^T,G,P), we address the log-optimal portfolio problem in many aspects. In particular, we answer the following questions and beyond: 1) What are the necessary and sufficient conditions for the existence of log-optimal portfolio of the model under consideration? 2) what are the various type of risks induced by T that affect this portfolio and how? 3) What are the factors that completely describe the sensitivity of the log-portfolio to the parameters of T? The answers to these questions and other related discussions definitely complement the work of Choulli and Yansori [12] which deals with the stopped model (S^T,G).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

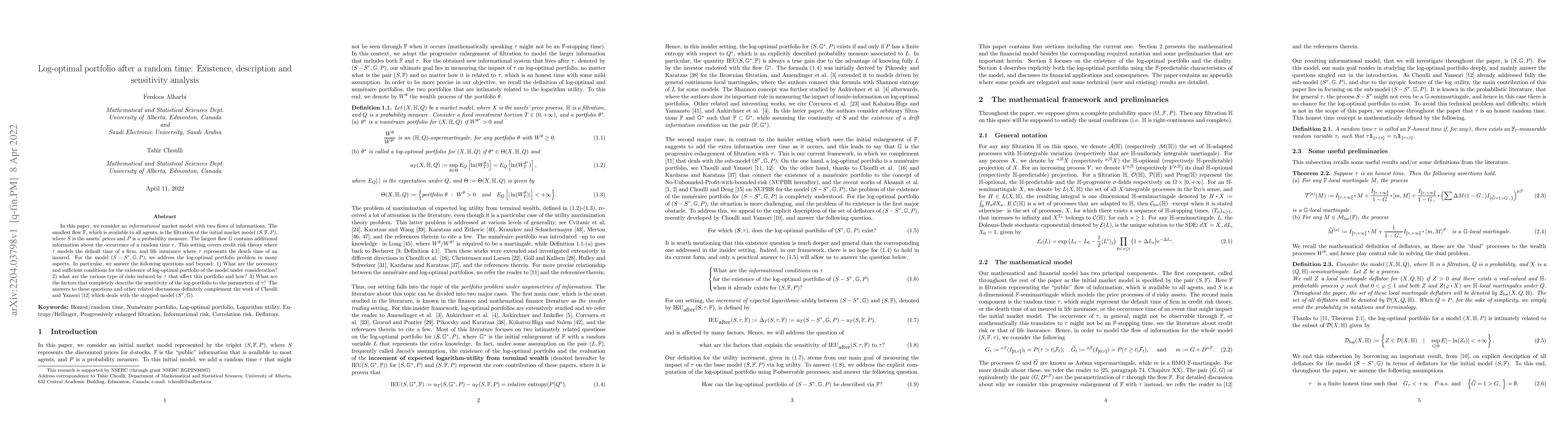

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Data-Driven Log-Optimal Portfolio: A Sliding Window Approach

Chung-Han Hsieh, Pei-Ting Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)