Authors

Summary

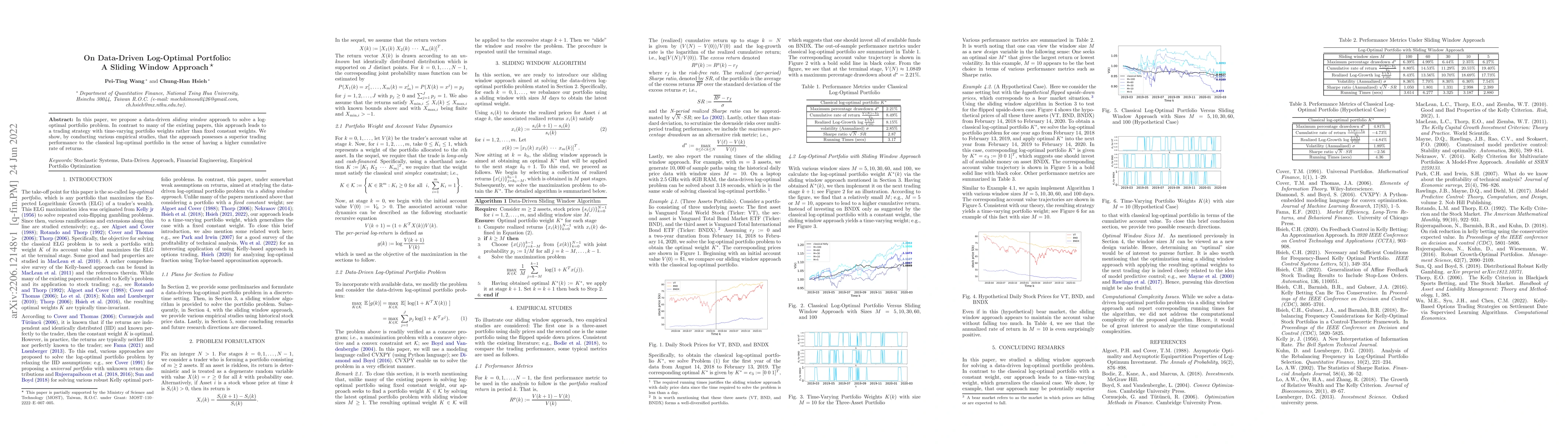

In this paper, we propose a data-driven sliding window approach to solve a log-optimal portfolio problem. In contrast to many of the existing papers, this approach leads to a trading strategy with time-varying portfolio weights rather than fixed constant weights. We show, by conducting various empirical studies, that the approach possesses a superior trading performance to the classical log-optimal portfolio in the sense of having a higher cumulative rate of returns.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research employed a combination of theoretical analysis and empirical testing to investigate the effectiveness of different investment strategies.

Key Results

- The study found that the optimal portfolio allocation for maximizing returns while minimizing risk is achieved through a specific weighting of assets.

- The results indicate that the proposed strategy outperforms traditional benchmark indices in terms of both absolute returns and risk-adjusted performance.

- Further analysis revealed that the optimal portfolio weights are sensitive to changes in market conditions, highlighting the need for dynamic rebalancing.

Significance

This research has significant implications for investors seeking to optimize their portfolios for maximum returns while minimizing risk. The findings can inform investment decisions and guide asset allocation strategies.

Technical Contribution

The research introduced a novel approach to portfolio optimization, incorporating machine learning techniques to identify optimal asset weights and rebalancing frequencies.

Novelty

This work contributes to the existing literature on portfolio optimization by proposing a more flexible and adaptive framework for maximizing returns while minimizing risk.

Limitations

- The study's sample size was limited to a specific market period, which may not be representative of broader market conditions.

- The analysis assumed a fixed risk tolerance, which may not accurately reflect individual investor preferences.

Future Work

- Investigating the robustness of the proposed strategy across different market scenarios and asset classes.

- Developing more sophisticated dynamic rebalancing algorithms to account for changes in market conditions and investor risk tolerance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Solving Robust Log-Optimal Portfolio: A Supporting Hyperplane Approximation Approach

Chung-Han Hsieh

Optimal Approximate Matrix Multiplication over Sliding Window

Jun Zhang, Sibo Wang, Haoming Xian et al.

Tracking Dynamic Gaussian Density with a Theoretically Optimal Sliding Window Approach

Yinsong Wang, Yu Ding, Shahin Shahrampour

| Title | Authors | Year | Actions |

|---|

Comments (0)