Summary

This paper addresses the log-optimal portfolio for a general semimartingale model. The most advanced literature on the topic elaborates existence and characterization of this portfolio under no-free-lunch-with-vanishing-risk assumption (NFLVR). There are many financial models violating NFLVR, while admitting the log-optimal portfolio on the one hand. On the other hand, for financial markets under progressively enlargement of filtration, NFLVR remains completely an open issue, and hence the literature can be applied to these models. Herein, we provide a complete characterization of log-optimal portfolio and its associated optimal deflator, necessary and sufficient conditions for their existence, and we elaborate their duality as well without NFLVR.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

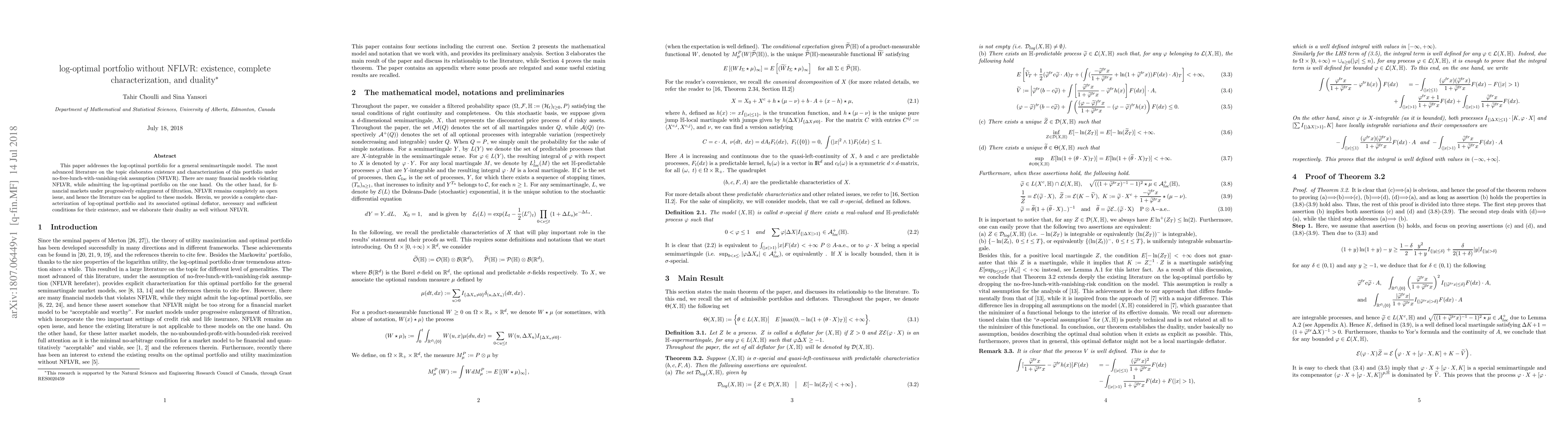

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLog-optimal portfolio after a random time: Existence, description and sensitivity analysis

Tahir Choulli, Ferdoos Alharbi

On Cost-Sensitive Distributionally Robust Log-Optimal Portfolio

Chung-Han Hsieh, Xiao-Rou Yu

On Data-Driven Log-Optimal Portfolio: A Sliding Window Approach

Chung-Han Hsieh, Pei-Ting Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)