Authors

Summary

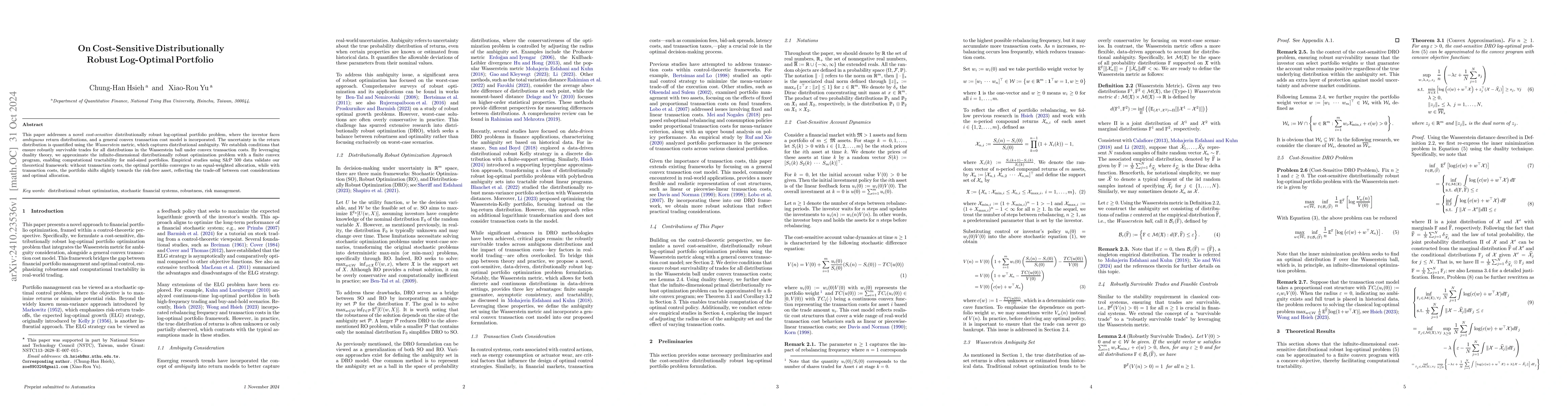

This paper addresses a novel \emph{cost-sensitive} distributionally robust log-optimal portfolio problem, where the investor faces \emph{ambiguous} return distributions, and a general convex transaction cost model is incorporated. The uncertainty in the return distribution is quantified using the \emph{Wasserstein} metric, which captures distributional ambiguity. We establish conditions that ensure robustly survivable trades for all distributions in the Wasserstein ball under convex transaction costs. By leveraging duality theory, we approximate the infinite-dimensional distributionally robust optimization problem with a finite convex program, enabling computational tractability for mid-sized portfolios. Empirical studies using S\&P 500 data validate our theoretical framework: without transaction costs, the optimal portfolio converges to an equal-weighted allocation, while with transaction costs, the portfolio shifts slightly towards the risk-free asset, reflecting the trade-off between cost considerations and optimal allocation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Solving Robust Log-Optimal Portfolio: A Supporting Hyperplane Approximation Approach

Chung-Han Hsieh

Distributionally Robust End-to-End Portfolio Construction

Giorgio Costa, Garud N. Iyengar

Cardinality-constrained Distributionally Robust Portfolio Optimization

Yuichi Takano, Ken Kobayashi, Kazuhide Nakata

No citations found for this paper.

Comments (0)