Authors

Summary

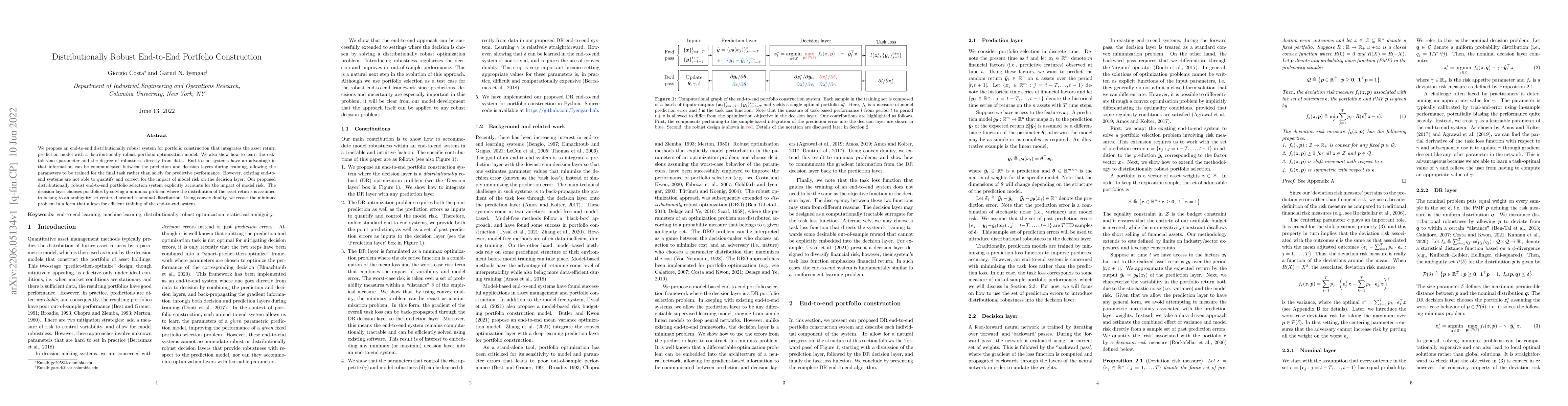

We propose an end-to-end distributionally robust system for portfolio construction that integrates the asset return prediction model with a distributionally robust portfolio optimization model. We also show how to learn the risk-tolerance parameter and the degree of robustness directly from data. End-to-end systems have an advantage in that information can be communicated between the prediction and decision layers during training, allowing the parameters to be trained for the final task rather than solely for predictive performance. However, existing end-to-end systems are not able to quantify and correct for the impact of model risk on the decision layer. Our proposed distributionally robust end-to-end portfolio selection system explicitly accounts for the impact of model risk. The decision layer chooses portfolios by solving a minimax problem where the distribution of the asset returns is assumed to belong to an ambiguity set centered around a nominal distribution. Using convex duality, we recast the minimax problem in a form that allows for efficient training of the end-to-end system.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDSPO: An End-to-End Framework for Direct Sorted Portfolio Construction

Jian Guo, Qiang Xu, Jianyuan Zhong et al.

ASI++: Towards Distributionally Balanced End-to-End Generative Retrieval

Qi Zhang, Minghui Song, Zihan Zhang et al.

Prescribing Decision Conservativeness in Two-Stage Power Markets: A Distributionally Robust End-to-End Approach

Qi Li, Anqi Liu, Zhirui Liang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)