Summary

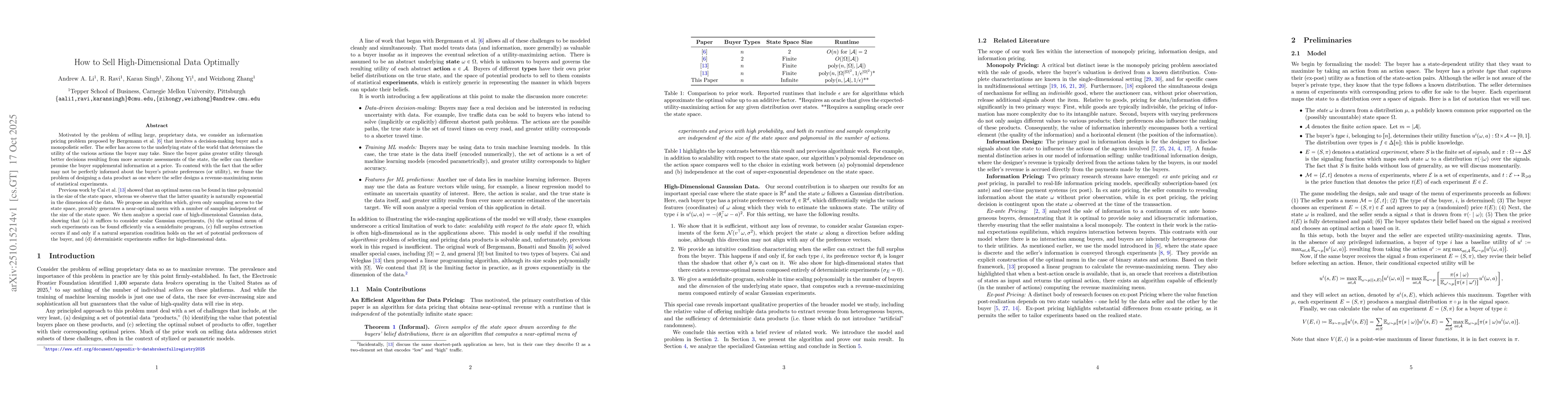

Motivated by the problem of selling large, proprietary data, we consider an information pricing problem proposed by Bergemann et al. that involves a decision-making buyer and a monopolistic seller. The seller has access to the underlying state of the world that determines the utility of the various actions the buyer may take. Since the buyer gains greater utility through better decisions resulting from more accurate assessments of the state, the seller can therefore promise the buyer supplemental information at a price. To contend with the fact that the seller may not be perfectly informed about the buyer's private preferences (or utility), we frame the problem of designing a data product as one where the seller designs a revenue-maximizing menu of statistical experiments. Prior work by Cai et al. showed that an optimal menu can be found in time polynomial in the state space, whereas we observe that the state space is naturally exponential in the dimension of the data. We propose an algorithm which, given only sampling access to the state space, provably generates a near-optimal menu with a number of samples independent of the state space. We then analyze a special case of high-dimensional Gaussian data, showing that (a) it suffices to consider scalar Gaussian experiments, (b) the optimal menu of such experiments can be found efficiently via a semidefinite program, and (c) full surplus extraction occurs if and only if a natural separation condition holds on the set of potential preferences of the buyer.

AI Key Findings

Generated Oct 21, 2025

Methodology

The research employs a combination of algorithmic analysis and game-theoretic modeling to study information selling mechanisms, focusing on designing optimal pricing strategies for data products with high-dimensional state spaces.

Key Results

- The algorithm achieves near-optimal revenue with sample complexity and runtime independent of the state space size

- A compact characterization of data product spaces for Gaussian data is provided

- A necessary and sufficient condition for full surplus extraction is identified

Significance

This work addresses the challenge of efficiently pricing high-dimensional data in information markets, offering practical algorithms and theoretical insights for real-world data monetization scenarios.

Technical Contribution

Development of an algorithmic framework for information selling that achieves near-optimal revenue with computational efficiency independent of state space dimensions

Novelty

Introduces a novel connection between information selling and Blackwell's comparison of experiments, providing both algorithmic solutions and theoretical guarantees for high-dimensional data pricing

Limitations

- The analysis assumes Gaussian data distributions which may not capture all real-world data characteristics

- The deterministic signaling approach may not be optimal for all types of data products

Future Work

- Exploring non-Gaussian data distributions and their impact on pricing mechanisms

- Investigating the trade-offs between randomization and determinism in data selling strategies

- Extending the framework to dynamic data markets with evolving information needs

Paper Details

PDF Preview

Similar Papers

Found 5 papersOptimally Weighted PCA for High-Dimensional Heteroscedastic Data

Fan Yang, Jeffrey A. Fessler, Laura Balzano et al.

Agent-Designed Contracts: How to Sell Hidden Actions

Andrea Celli, Matteo Castiglioni, Martino Bernasconi

How to Play Optimally for Regular Objectives?

Pierre Vandenhove, Nathanaël Fijalkow, Patricia Bouyer et al.

Comments (0)