Summary

Financial time-series forecasting remains a challenging task due to complex temporal dependencies and market fluctuations. This study explores the potential of hybrid quantum-classical approaches to assist in financial trend prediction by leveraging quantum resources for improved feature representation and learning. A custom Quantum Neural Network (QNN) regressor is introduced, designed with a novel ansatz tailored for financial applications. Two hybrid optimization strategies are proposed: (1) a sequential approach where classical recurrent models (RNN/LSTM) extract temporal dependencies before quantum processing, and (2) a joint learning framework that optimizes classical and quantum parameters simultaneously. Systematic evaluation using TimeSeriesSplit, k-fold cross-validation, and predictive error analysis highlights the ability of these hybrid models to integrate quantum computing into financial forecasting workflows. The findings demonstrate how quantum-assisted learning can contribute to financial modeling, offering insights into the practical role of quantum resources in time-series analysis.

AI Key Findings

Generated Jun 10, 2025

Methodology

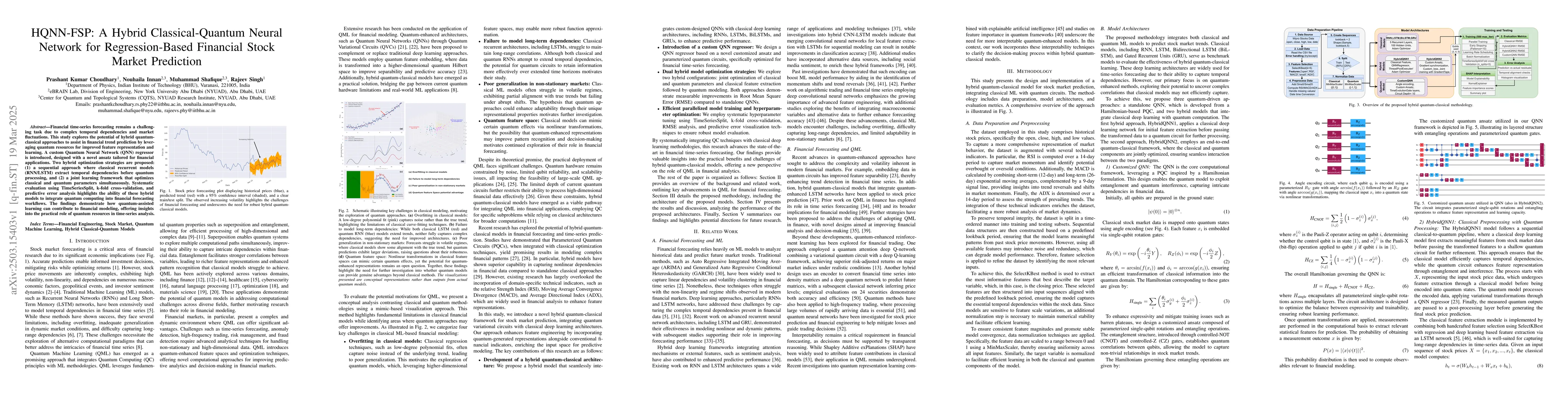

This study presents a hybrid quantum-classical model for stock market prediction, integrating classical ML with quantum circuits. It includes data preparation, model architectures, and evaluation metrics. The approach involves angle encoding of classical stock market data into quantum states, followed by quantum processing to capture complex dependencies. Three quantum-driven approaches are explored: a standalone QNN, and two hybrid models (HybridQNN1 and HybridQNN2) that integrate classical deep learning with quantum computation.

Key Results

- Hybrid quantum-classical models (HybridQNN1 and HybridQNN2) outperform a standalone quantum model (CustomQNN) in predictive accuracy for stock market trends.

- HybridQNN2, in particular, achieves the lowest RMSE across all configurations, demonstrating the effectiveness of hybridization in mitigating quantum limitations.

- The models show promise in capturing general price levels and broader trends, but struggle with rapid market transitions, indicating a need for adaptive mechanisms to improve responsiveness to abrupt changes.

- Error analysis reveals that HybridQNN models have lower variance and are more stable, as indicated by narrower Gaussian error distributions and violin plots.

- Despite improvements over standalone quantum models, hybrid models still face computational trade-offs, with increased qubit counts enhancing predictive performance but significantly prolonging training times.

Significance

This research is significant as it explores the potential of hybrid quantum-classical models for financial forecasting, offering a path toward quantum-enhanced predictive analytics. As quantum hardware advances, such hybrid models could transform financial decision-making by providing enhanced accuracy, interpretability, and deeper insights into complex market dynamics.

Technical Contribution

The paper introduces a hybrid quantum-classical neural network (HQNN-FSP) for regression-based financial stock market prediction, leveraging quantum resources for improved feature representation and learning. It proposes two hybrid optimization strategies: a sequential approach and a joint learning framework.

Novelty

This work is novel in its application of hybrid quantum-classical neural networks for financial time-series forecasting, incorporating a custom Quantum Neural Network (QNN) regressor with a novel ansatz tailored for financial applications. It also presents two hybrid optimization strategies that optimize classical and quantum parameters simultaneously, contributing to the integration of quantum computing in financial forecasting workflows.

Limitations

- Quantum circuit execution is resource-intensive, and performance is constrained by the current state of Noisy Intermediate-Scale Quantum (NISQ) devices.

- The study did not surpass the performance of state-of-the-art classical deep learning methods like LSTM and BiLSTM in terms of RMSE.

Future Work

- Explore larger-scale quantum architectures, including noise-resilient quantum processors, to enhance model scalability and precision.

- Extend the model with larger datasets and additional financial indicators to improve adaptability and generalization.

- Test real-time applications on quantum hardware to assess practical feasibility in financial markets.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQADQN: Quantum Attention Deep Q-Network for Financial Market Prediction

Muhammad Shafique, Alberto Marchisio, Nouhaila Innan et al.

No citations found for this paper.

Comments (0)