Summary

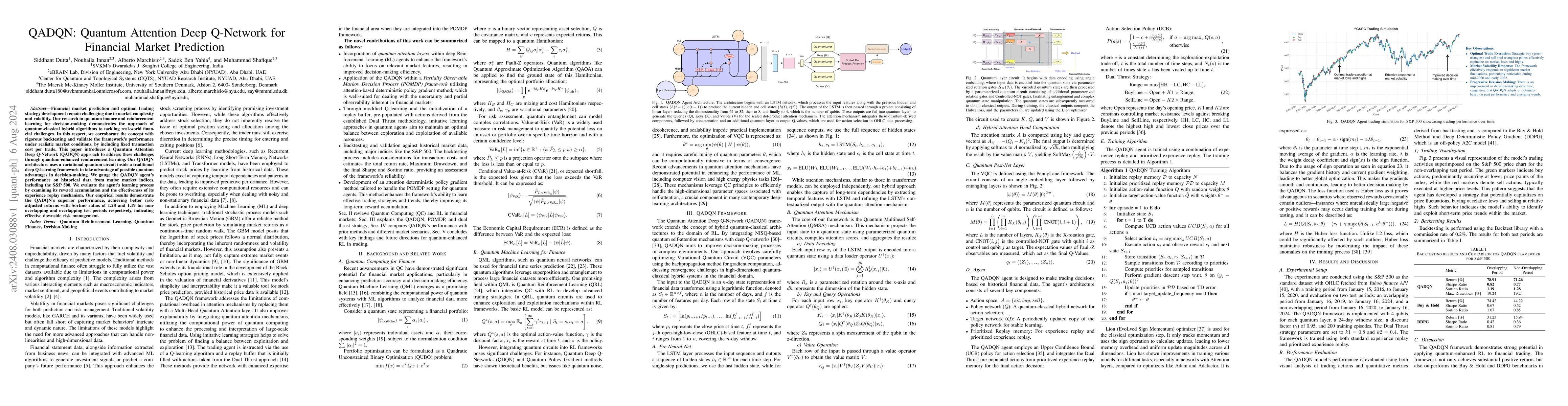

Financial market prediction and optimal trading strategy development remain challenging due to market complexity and volatility. Our research in quantum finance and reinforcement learning for decision-making demonstrates the approach of quantum-classical hybrid algorithms to tackling real-world financial challenges. In this respect, we corroborate the concept with rigorous backtesting and validate the framework's performance under realistic market conditions, by including fixed transaction cost per trade. This paper introduces a Quantum Attention Deep Q-Network (QADQN) approach to address these challenges through quantum-enhanced reinforcement learning. Our QADQN architecture uses a variational quantum circuit inside a traditional deep Q-learning framework to take advantage of possible quantum advantages in decision-making. We gauge the QADQN agent's performance on historical data from major market indices, including the S&P 500. We evaluate the agent's learning process by examining its reward accumulation and the effectiveness of its experience replay mechanism. Our empirical results demonstrate the QADQN's superior performance, achieving better risk-adjusted returns with Sortino ratios of 1.28 and 1.19 for non-overlapping and overlapping test periods respectively, indicating effective downside risk management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHQNN-FSP: A Hybrid Classical-Quantum Neural Network for Regression-Based Financial Stock Market Prediction

Muhammad Shafique, Rajeev Singh, Nouhaila Innan et al.

Multi-head Temporal Attention-Augmented Bilinear Network for Financial time series prediction

Martin Magris, Mostafa Shabani, Alexandros Iosifidis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)