Authors

Summary

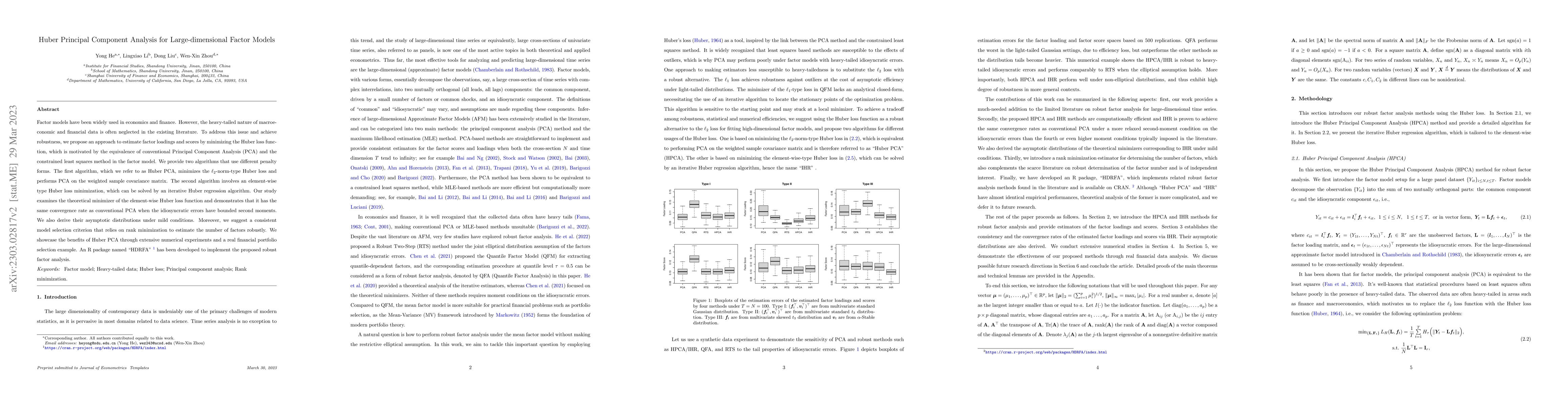

Factor models have been widely used in economics and finance. However, the heavy-tailed nature of macroeconomic and financial data is often neglected in the existing literature. To address this issue and achieve robustness, we propose an approach to estimate factor loadings and scores by minimizing the Huber loss function, which is motivated by the equivalence of conventional Principal Component Analysis (PCA) and the constrained least squares method in the factor model. We provide two algorithms that use different penalty forms. The first algorithm, which we refer to as Huber PCA, minimizes the $\ell_2$-norm-type Huber loss and performs PCA on the weighted sample covariance matrix. The second algorithm involves an element-wise type Huber loss minimization, which can be solved by an iterative Huber regression algorithm. Our study examines the theoretical minimizer of the element-wise Huber loss function and demonstrates that it has the same convergence rate as conventional PCA when the idiosyncratic errors have bounded second moments. We also derive their asymptotic distributions under mild conditions. Moreover, we suggest a consistent model selection criterion that relies on rank minimization to estimate the number of factors robustly. We showcase the benefits of Huber PCA through extensive numerical experiments and a real financial portfolio selection example. An R package named ``HDRFA" has been developed to implement the proposed robust factor analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeneralized Principal Component Analysis for Large-dimensional Matrix Factor Model

Yalin Wang, Yong He, Haixia Liu et al.

Penalized Principal Component Analysis for Large-dimension Factor Model with Group Pursuit

Dong Liu, Yiming Wang, Yong He et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)