Summary

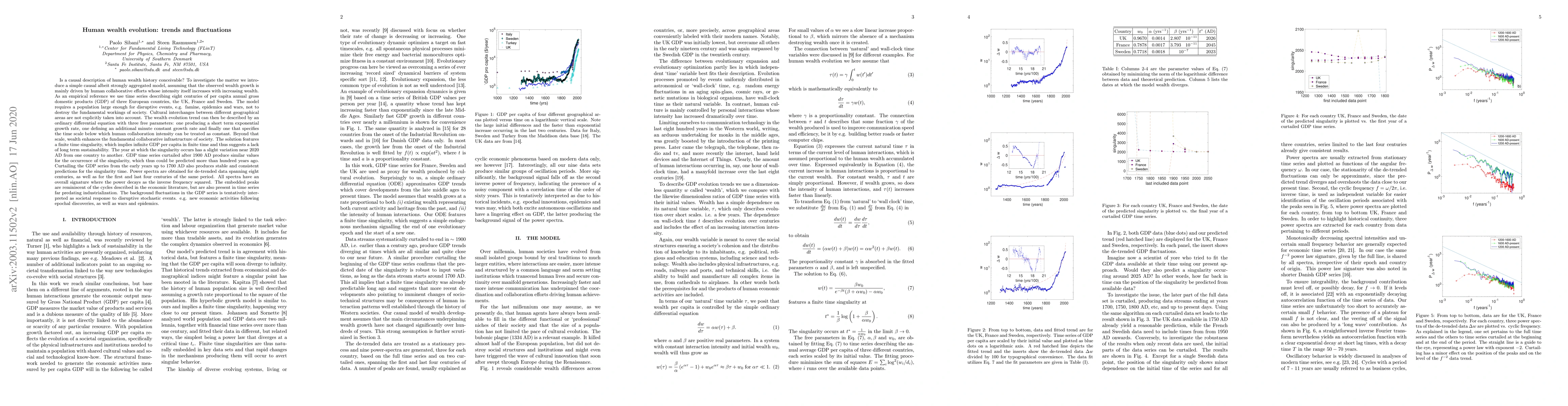

Is a causal description of human wealth history conceivable? To investigate the matter we introduce a simple causal albeit strongly aggregated model, assuming that the observed wealth growth is mainly driven by human collaborative efforts whose intensity itself increases with increasing wealth. As an empirical reference we use time series describing eight centuries of per capita annual gross domestic products (GDP) of three European countries, the UK, France and Sweden. The model requires a population large enough for disruptive events, e.g. famine, epidemics and wars, not to destroy the fundamental workings of society. The wealth evolution trend can then be described by an ordinary differential equation with three free parameters. The solution features a finite time singularity, which suggests a lack of long term sustainability. The year at which the singularity occurs has a slight variation near 2020 AD from one country to another. GDP time series curtailed after 1900 AD produce similar values for the occurrence of the singularity, which thus could be predicted more than hundred years ago. Curtailing the GDP series from the early years up to 1700 AD also produces stable and consistent predictions for the singularity time. {Power spectra are obtained for de-trended data spanning eight centuries, as well as for the first and last four centuries of the same period. All spectra have an overall signature where the power decays as the inverse frequency squared. The embedded peaks are reminiscent of the cycles described in the economic literature, but are also present in time series far predating industrialization. The background fluctuations in the GDP series is tentatively interpreted as societal response to disruptive stochastic events. e.g. new economic activities following epochal discoveries, as well as wars and epidemics

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHuman wealth evolution is an accelerating expansion underpinned by a decelerating optimization process

Steen Rasmussen, Paolo Sibani, Per Lyngs Hansen

| Title | Authors | Year | Actions |

|---|

Comments (0)