Authors

Summary

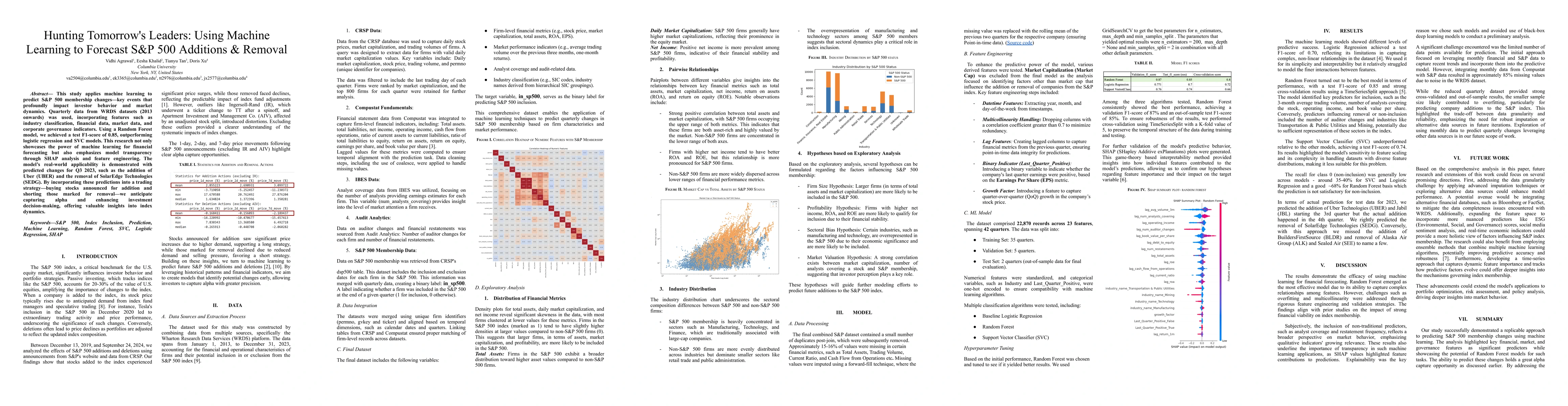

This study applies machine learning to predict S&P 500 membership changes: key events that profoundly impact investor behavior and market dynamics. Quarterly data from WRDS datasets (2013 onwards) was used, incorporating features such as industry classification, financial data, market data, and corporate governance indicators. Using a Random Forest model, we achieved a test F1 score of 0.85, outperforming logistic regression and SVC models. This research not only showcases the power of machine learning for financial forecasting but also emphasizes model transparency through SHAP analysis and feature engineering. The model's real world applicability is demonstrated with predicted changes for Q3 2023, such as the addition of Uber (UBER) and the removal of SolarEdge Technologies (SEDG). By incorporating these predictions into a trading strategy i.e. buying stocks announced for addition and shorting those marked for removal, we anticipate capturing alpha and enhancing investment decision making, offering valuable insights into index dynamics

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersThe Hybrid Forecast of S&P 500 Volatility ensembled from VIX, GARCH and LSTM models

Natalia Roszyk, Robert Ślepaczuk

S&P 500 Stock Price Prediction Using Technical, Fundamental and Text Data

Shan Zhong, David B. Hitchcock

No citations found for this paper.

Comments (0)