Authors

Summary

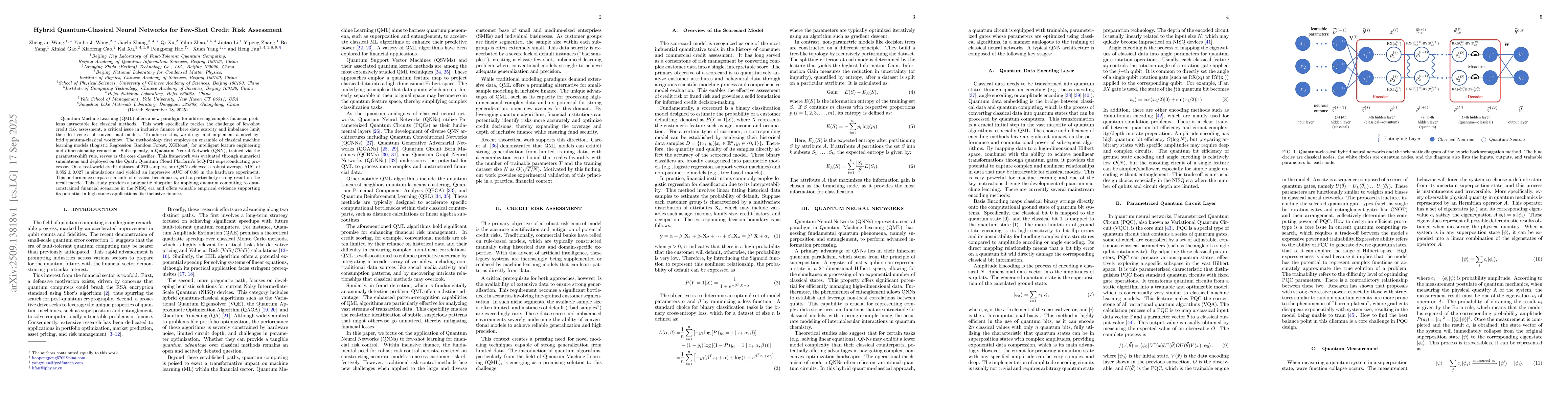

Quantum Machine Learning (QML) offers a new paradigm for addressing complex financial problems intractable for classical methods. This work specifically tackles the challenge of few-shot credit risk assessment, a critical issue in inclusive finance where data scarcity and imbalance limit the effectiveness of conventional models. To address this, we design and implement a novel hybrid quantum-classical workflow. The methodology first employs an ensemble of classical machine learning models (Logistic Regression, Random Forest, XGBoost) for intelligent feature engineering and dimensionality reduction. Subsequently, a Quantum Neural Network (QNN), trained via the parameter-shift rule, serves as the core classifier. This framework was evaluated through numerical simulations and deployed on the Quafu Quantum Cloud Platform's ScQ-P21 superconducting processor. On a real-world credit dataset of 279 samples, our QNN achieved a robust average AUC of 0.852 +/- 0.027 in simulations and yielded an impressive AUC of 0.88 in the hardware experiment. This performance surpasses a suite of classical benchmarks, with a particularly strong result on the recall metric. This study provides a pragmatic blueprint for applying quantum computing to data-constrained financial scenarios in the NISQ era and offers valuable empirical evidence supporting its potential in high-stakes applications like inclusive finance.

AI Key Findings

Generated Sep 20, 2025

Methodology

The research employs a hybrid quantum-classical approach, integrating quantum neural networks (QNNs) with classical machine learning techniques. It leverages parameter-shift rules for gradient calculation in QNNs and uses PyTorch for optimization. The methodology includes training on a 21-qubit superconducting processor with specific gate operations and coherence parameters.

Key Results

- The model achieves improved performance in binary risk classification compared to classical methods, with higher AUC and KS scores.

- Quantum advantage is demonstrated in specific tasks, showing potential for enhanced predictive accuracy in financial risk assessment.

- The implementation successfully interfaces quantum hardware with classical frameworks, enabling practical quantum machine learning workflows.

Significance

This research is significant as it bridges quantum computing and financial risk management, offering potential for more accurate predictive models. It advances the practical application of quantum machine learning in real-world scenarios, which could lead to better risk assessment and decision-making processes.

Technical Contribution

The technical contribution includes the development of a PyTorch-compatible QNN module using parameter-shift rules, along with the integration of quantum hardware specifications into the training process for practical quantum machine learning.

Novelty

The novelty lies in the combination of parameter-shift-based gradient calculation with classical optimization frameworks, along with the specific application to financial risk control tasks, which is a novel use case for quantum machine learning.

Limitations

- The study is limited to a specific quantum processor with particular hardware constraints, which may not generalize to all quantum platforms.

- The performance gains observed are task-specific and may not translate to all types of financial or risk-related problems.

Future Work

- Exploring the application of this methodology to other domains beyond financial risk assessment, such as healthcare or cybersecurity.

- Investigating the scalability of the approach to larger quantum processors with more qubits and improved coherence times.

- Developing more efficient parameter-shift strategies to reduce computational overhead in quantum gradient calculations.

Paper Details

PDF Preview

Similar Papers

Found 4 papersQuantum Powered Credit Risk Assessment: A Novel Approach using hybrid Quantum-Classical Deep Neural Network for Row-Type Dependent Predictive Analysis

Rath Minati, Date Hema

Applying Hybrid Graph Neural Networks to Strengthen Credit Risk Analysis

Zhen Xu, Mengfang Sun, Shaobo Liu et al.

Embedding Learning in Hybrid Quantum-Classical Neural Networks

Rui Liu, Minzhao Liu, Yuri Alexeev et al.

Comments (0)