Authors

Summary

The integration of Quantum Deep Learning (QDL) techniques into the landscape of financial risk analysis presents a promising avenue for innovation. This study introduces a framework for credit risk assessment in the banking sector, combining quantum deep learning techniques with adaptive modeling for Row-Type Dependent Predictive Analysis (RTDPA). By leveraging RTDPA, the proposed approach tailors predictive models to different loan categories, aiming to enhance the accuracy and efficiency of credit risk evaluation. While this work explores the potential of integrating quantum methods with classical deep learning for risk assessment, it focuses on the feasibility and performance of this hybrid framework rather than claiming transformative industry-wide impacts. The findings offer insights into how quantum techniques can complement traditional financial analysis, paving the way for further advancements in predictive modeling for credit risk.

AI Key Findings

Generated Jun 11, 2025

Methodology

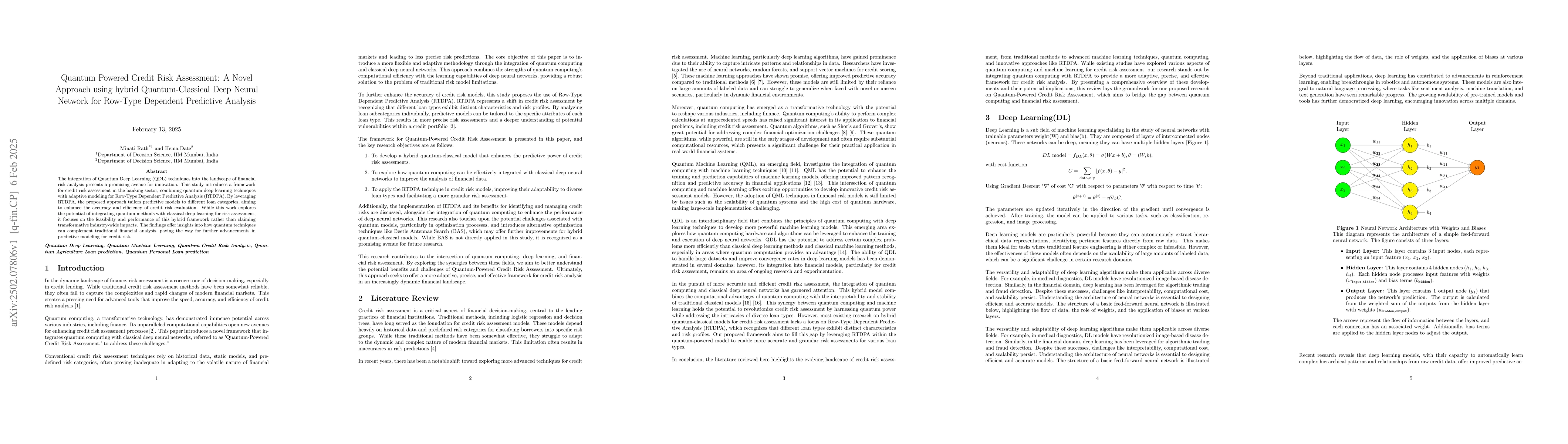

This study introduces a hybrid quantum-classical deep neural network (HyQuC-DeepNN-RTDPA) for credit risk assessment, leveraging Row-Type Dependent Predictive Analysis (RTDPA) to tailor predictive models to different loan categories, enhancing accuracy and efficiency in credit risk evaluation.

Key Results

- The HyQuC-DeepNN-RTDPA model demonstrates improved performance in credit risk analysis by effectively managing diverse row types and detecting subtle correlations between features.

- The model achieves an overall accuracy of 0.8348 for personal loans, although class imbalance may mislead this metric; weighted average precision of 0.9415 suggests better performance when considering class sizes.

- For agricultural loans, the model achieves an overall accuracy of 0.81, with macro-average precision of 0.52 and recall of 0.69, indicating room for improvement, particularly in minority classes like 'SubStandard'.

Significance

This research presents a novel approach to integrate quantum deep learning techniques with classical deep learning for credit risk assessment, providing insights into how quantum methods can complement traditional financial analysis and paving the way for advancements in predictive modeling for credit risk.

Technical Contribution

The HyQuC-DeepNN-RTDPA model combines quantum and classical deep learning layers, enabling it to manage diverse row types and improve risk discrimination through quantum operations like entanglement and quantum measurement.

Novelty

This work stands out by proposing a hybrid quantum-classical deep neural network tailored for row-type dependent predictive analysis in credit risk assessment, showcasing the potential of quantum techniques in enhancing traditional financial analysis.

Limitations

- The study was conducted with hardware limitations, impacting the ability to perform computationally intensive operations and conduct extensive hyperparameter tuning.

- Dimensionality reduction using Principal Component Analysis (PCA) may have resulted in the loss of critical information, potentially compromising the model's ability to accurately differentiate between various loan statuses.

Future Work

- Investigate the impact of various balancing techniques, such as SMOTE and its variants, on model performance for handling class imbalance.

- Explore additional hyperparameters, such as quantum circuit design, learning rate schedules, optimizer choices, dropout rates, and batch normalization, to further optimize model performance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHybrid Quantum-Classical Neural Networks for Few-Shot Credit Risk Assessment

Xuan Yang, Jintao Li, Kai Xu et al.

Adaptive Modelling Approach for Row-Type Dependent Predictive Analysis (RTDPA): A Framework for Designing Machine Learning Models for Credit Risk Analysis in Banking Sector

Minati Rath, Hema Date

Quantum Convolutional Neural Network: A Hybrid Quantum-Classical Approach for Iris Dataset Classification

S. M. Yousuf Iqbal Tomal, Abdullah Al Shafin, Afrida Afaf et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)