Authors

Summary

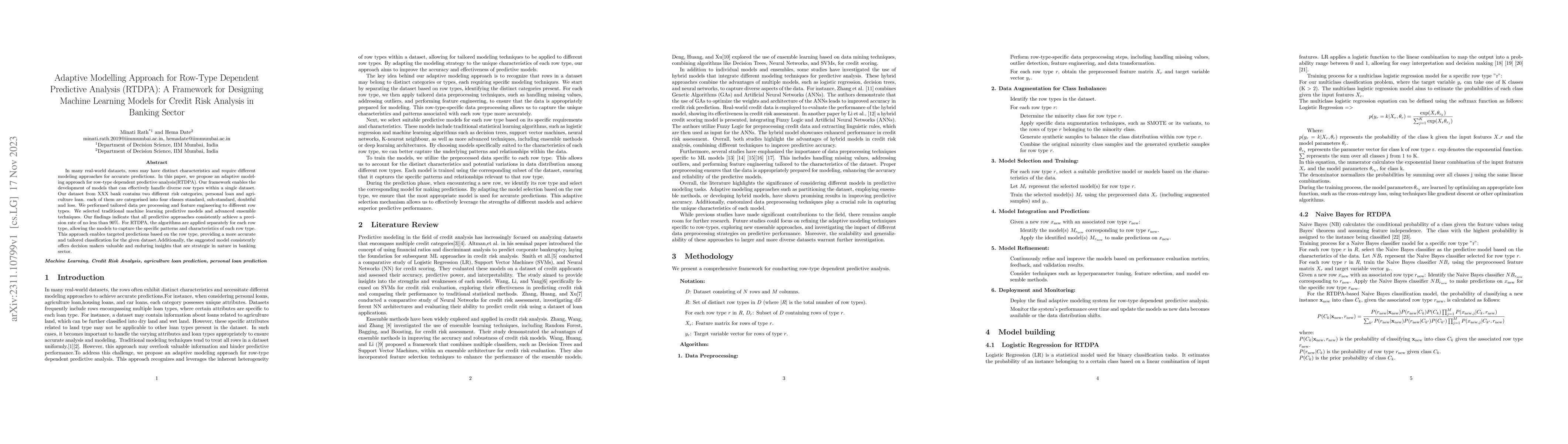

In many real-world datasets, rows may have distinct characteristics and require different modeling approaches for accurate predictions. In this paper, we propose an adaptive modeling approach for row-type dependent predictive analysis(RTDPA). Our framework enables the development of models that can effectively handle diverse row types within a single dataset. Our dataset from XXX bank contains two different risk categories, personal loan and agriculture loan. each of them are categorised into four classes standard, sub-standard, doubtful and loss. We performed tailored data pre processing and feature engineering to different row types. We selected traditional machine learning predictive models and advanced ensemble techniques. Our findings indicate that all predictive approaches consistently achieve a precision rate of no less than 90%. For RTDPA, the algorithms are applied separately for each row type, allowing the models to capture the specific patterns and characteristics of each row type. This approach enables targeted predictions based on the row type, providing a more accurate and tailored classification for the given dataset.Additionally, the suggested model consistently offers decision makers valuable and enduring insights that are strategic in nature in banking sector.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantum Powered Credit Risk Assessment: A Novel Approach using hybrid Quantum-Classical Deep Neural Network for Row-Type Dependent Predictive Analysis

Rath Minati, Date Hema

Analysing the Influence of Macroeconomic Factors on Credit Risk in the UK Banking Sector

Bayode Ogunleye, Oluwaseun Ajao, Hemlata Sharma et al.

Model Validation Practice in Banking: A Structured Approach for Predictive Models

Agus Sudjianto, Aijun Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)