Summary

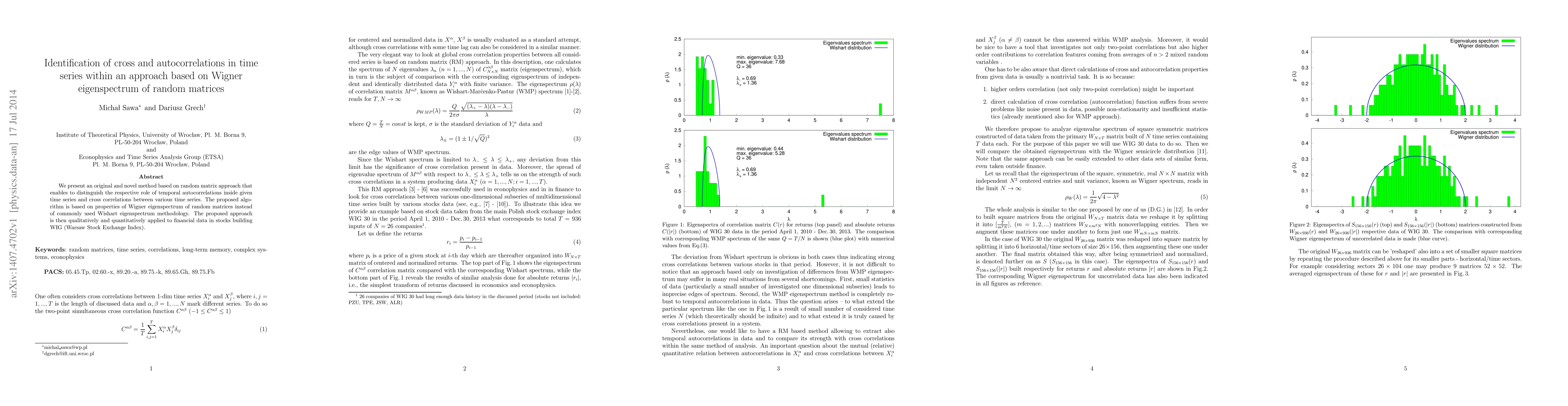

We present an original and novel method based on random matrix approach that enables to distinguish the respective role of temporal autocorrelations inside given time series and cross correlations between various time series. The proposed algorithm is based on properties of Wigner eigenspectrum of random matrices instead of commonly used Wishart eigenspectrum methodology. The proposed approach is then qualitatively and quantitatively applied to financial data in stocks building WIG (Warsaw Stock Exchange Index).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersMonitoring for a Phase Transition in a Time Series of Wigner Matrices

Piotr Kokoszka, Nina Dörnemann, Tim Kutta et al.

No citations found for this paper.

Comments (0)