Authors

Summary

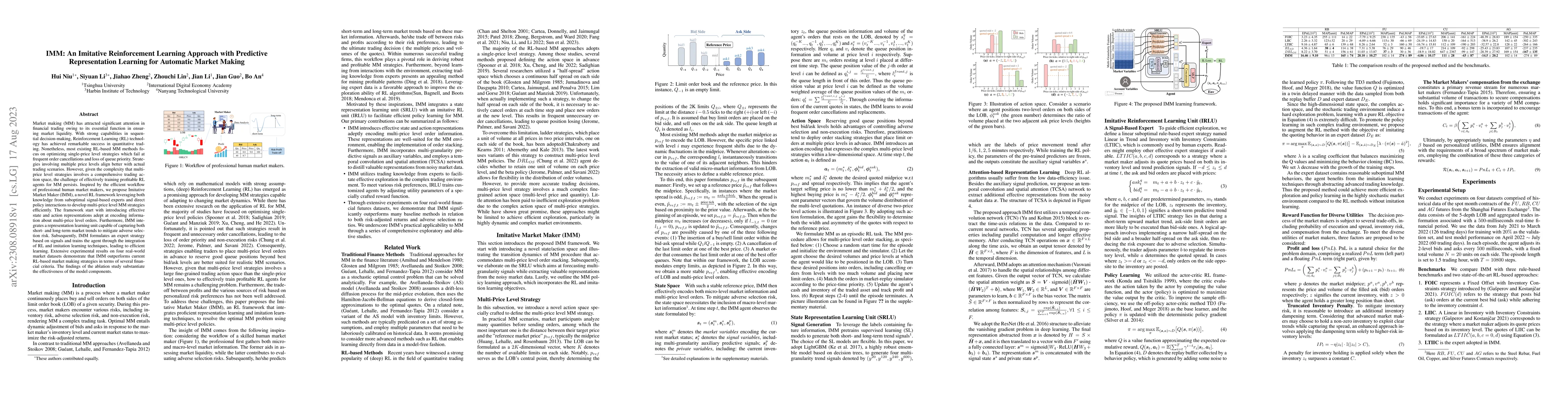

Market making (MM) has attracted significant attention in financial trading owing to its essential function in ensuring market liquidity. With strong capabilities in sequential decision-making, Reinforcement Learning (RL) technology has achieved remarkable success in quantitative trading. Nonetheless, most existing RL-based MM methods focus on optimizing single-price level strategies which fail at frequent order cancellations and loss of queue priority. Strategies involving multiple price levels align better with actual trading scenarios. However, given the complexity that multi-price level strategies involves a comprehensive trading action space, the challenge of effectively training profitable RL agents for MM persists. Inspired by the efficient workflow of professional human market makers, we propose Imitative Market Maker (IMM), a novel RL framework leveraging both knowledge from suboptimal signal-based experts and direct policy interactions to develop multi-price level MM strategies efficiently. The framework start with introducing effective state and action representations adept at encoding information about multi-price level orders. Furthermore, IMM integrates a representation learning unit capable of capturing both short- and long-term market trends to mitigate adverse selection risk. Subsequently, IMM formulates an expert strategy based on signals and trains the agent through the integration of RL and imitation learning techniques, leading to efficient learning. Extensive experimental results on four real-world market datasets demonstrate that IMM outperforms current RL-based market making strategies in terms of several financial criteria. The findings of the ablation study substantiate the effectiveness of the model components.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket Making via Reinforcement Learning in China Commodity Market

Junshu Jiang, Thomas Dierckx, Wim Schoutens et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)