Summary

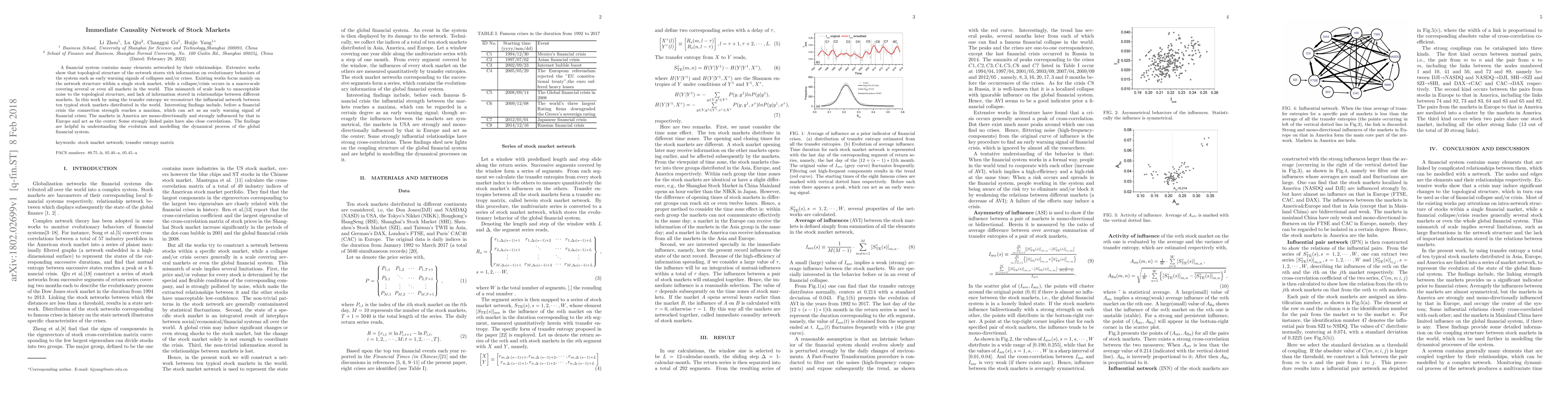

A financial system contains many elements networked by their relationships. Extensive works show that topological structure of the network stores rich information on evolutionary behaviors of the system such as early warning signals of collapses and/or crises. Existing works focus mainly on the network structure within a single stock market, while a collapse/crisis occurs in a macro-scale covering several or even all markets in the world. This mismatch of scale leads to unacceptable noise to the topological structure, and lack of information stored in relationships between different markets. In this work by using the transfer entropy we reconstruct the influential network between ten typical stock markets distributed in the world. Interesting findings include, before a financial crisis the connection strength reaches a maxima, which can act as an early warning signal of financial crises; The markets in America are mono-directionally and strongly influenced by that in Europe and act as the center; Some strongly linked pairs have also close correlations. The findings are helpful in understanding the evolution and modelling the dynamical process of the global financial system.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCausality Analysis of COVID-19 Induced Crashes in Stock and Commodity Markets: A Topological Perspective

Sushovan Majhi, Anish Rai, Buddha Nath Sharma et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)