Summary

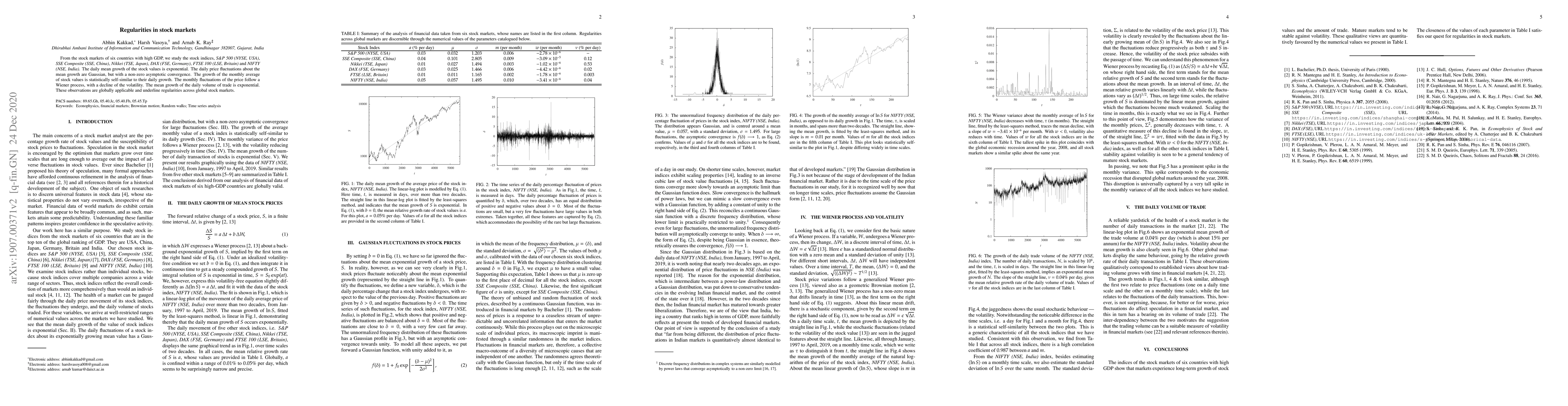

From the stock markets of six countries with high GDP, we study the stock indices, S&P 500 (NYSE, USA), SSE Composite (SSE, China), Nikkei (TSE, Japan), DAX (FSE, Germany), FTSE 100 (LSE, Britain) and NIFTY (NSE, India). The daily mean growth of the stock values is exponential. The daily price fluctuations about the mean growth are Gaussian, but with a non-zero asymptotic convergence. The growth of the monthly average of stock values is statistically self-similar to their daily growth. The monthly fluctuations of the price follow a Wiener process, with a decline of the volatility. The mean growth of the daily volume of trade is exponential. These observations are globally applicable and underline regularities across global stock markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)