Summary

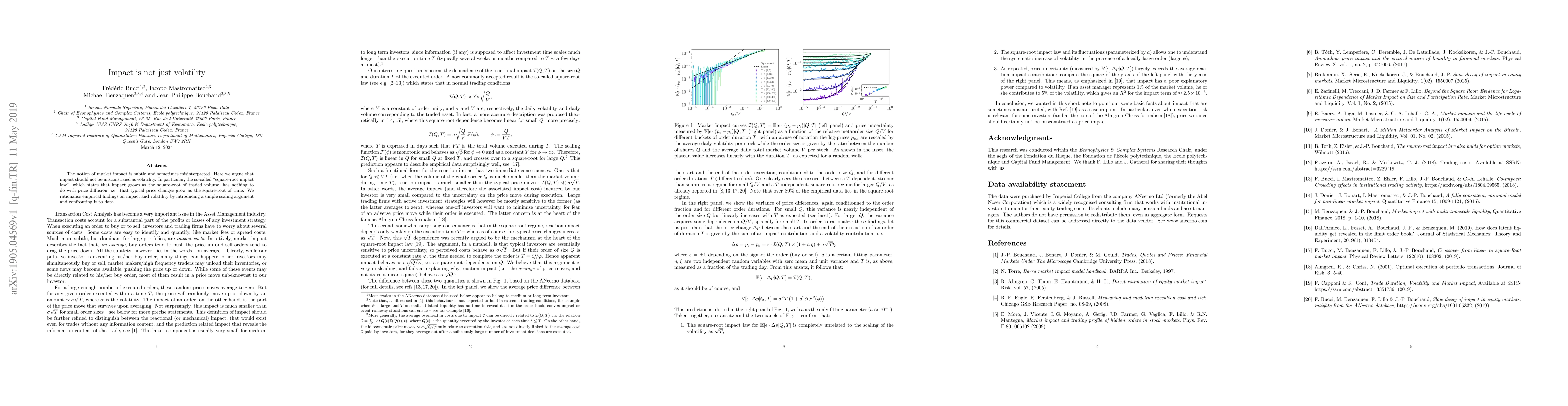

The notion of market impact is subtle and sometimes misinterpreted. Here we argue that impact should not be misconstrued as volatility. In particular, the so-called ``square-root impact law'', which states that impact grows as the square-root of traded volume, has nothing to do with price diffusion, i.e. that typical price changes grow as the square-root of time. We rationalise empirical findings on impact and volatility by introducing a simple scaling argument and confronting it to data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)