Authors

Summary

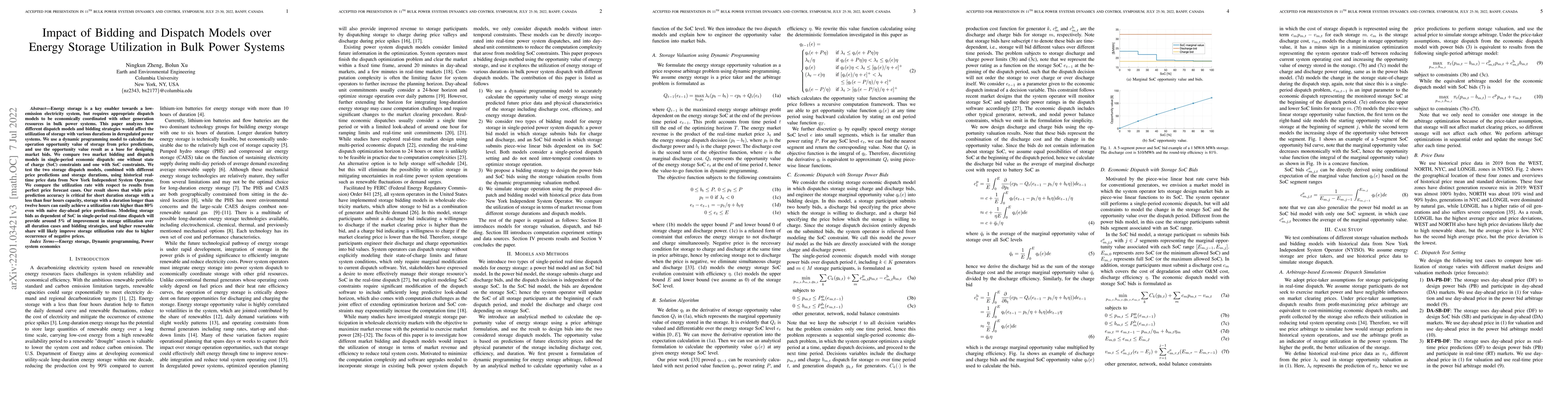

Energy storage is a key enabler towards a low-emission electricity system, but requires appropriate dispatch models to be economically coordinated with other generation resources in bulk power systems. This paper analyzes how different dispatch models and bidding strategies would affect the utilization of storage with various durations in deregulated power systems. We use a dynamic programming model to calculate the operation opportunity value of storage from price predictions, and use the opportunity value result as a base for designing market bids. We compare two market bidding and dispatch models in single-period economic dispatch: one without state of charge (SoC) constraints and one with SoC constraints. We test the two storage dispatch models, combined with different price predictions and storage durations, using historical real-time price data from New York Independent System Operator. We compare the utilization rate with respect to results from perfect price forecast cases. Our result shows that while price prediction accuracy is critical for short duration storage with a less than four hours capacity, storage with a duration longer than twelve hours can easily achieve a utilization rate higher than 80\% even with naive day-ahead price predictions. Modeling storage bids as dependent of SoC in single-period real-time dispatch will provide around 5% of improvement in storage utilization over all duration cases and bidding strategies, and higher renewable share will likely improve storage utilization rate due to higher occurrence of negative prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTowards Robust and Scalable Dispatch Modeling of Long-Duration Energy Storage

Bri-Mathias Hodge, Sourabh Dalvi, Amogh A. Thatte et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)