Authors

Summary

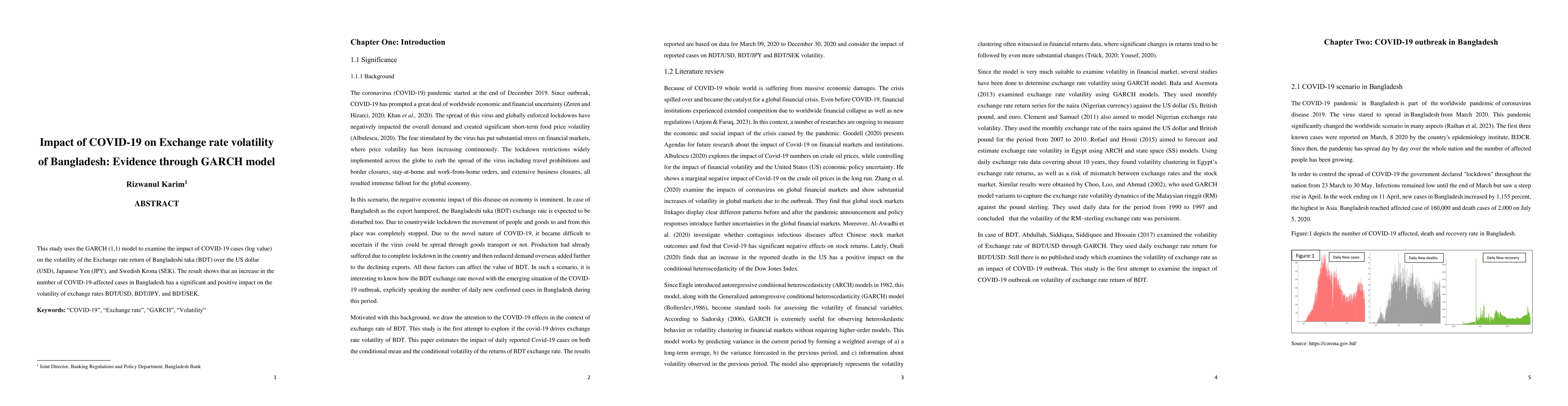

This study uses the GARCH (1,1) model to examine the impact of COVID-19 cases (log value) on the volatility of the Exchange rate return of Bangladeshi taka (BDT) over the US dollar (USD), Japanese Yen (JPY), and Swedish Krona (SEK). The result shows that an increase in the number of COVID-19-affected cases in Bangladesh has a significant and positive impact on the volatility of exchange rates BDT/USD, BDT/JPY, and BDT/SEK.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntraday foreign exchange rate volatility forecasting: univariate and multilevel functional GARCH models

Han Lin Shang, Yuqian Zhao, Fearghal Kearney

No citations found for this paper.

Comments (0)