Summary

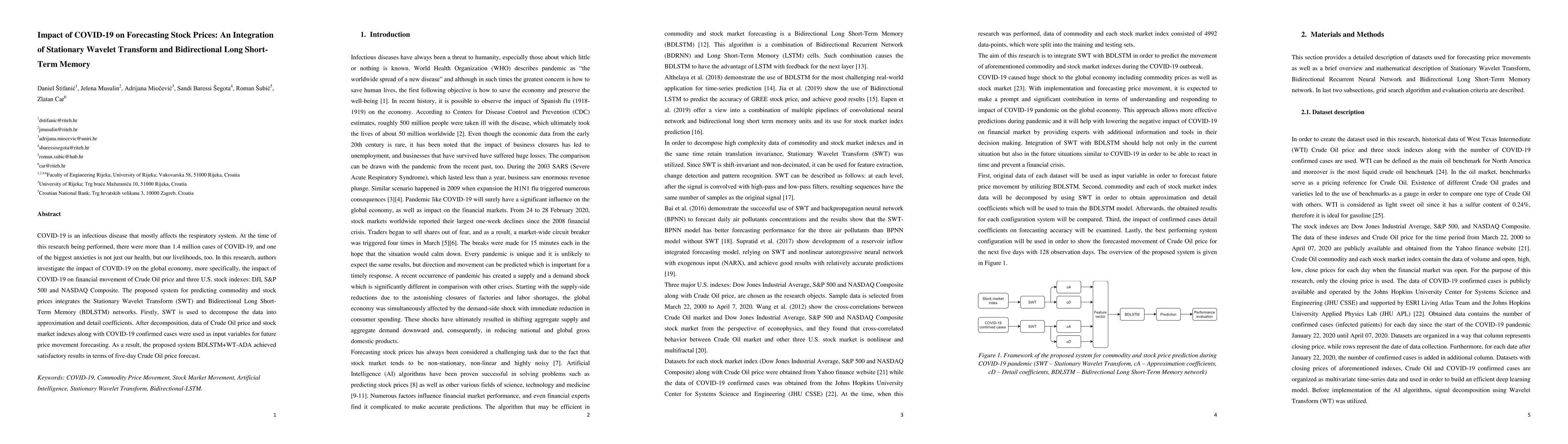

COVID-19 is an infectious disease that mostly affects the respiratory system. At the time of this research being performed, there were more than 1.4 million cases of COVID-19, and one of the biggest anxieties is not just our health, but our livelihoods, too. In this research, authors investigate the impact of COVID-19 on the global economy, more specifically, the impact of COVID-19 on financial movement of Crude Oil price and three U.S. stock indexes: DJI, S&P 500 and NASDAQ Composite. The proposed system for predicting commodity and stock prices integrates the Stationary Wavelet Transform (SWT) and Bidirectional Long Short-Term Memory (BDLSTM) networks. Firstly, SWT is used to decompose the data into approximation and detail coefficients. After decomposition, data of Crude Oil price and stock market indexes along with COVID-19 confirmed cases were used as input variables for future price movement forecasting. As a result, the proposed system BDLSTM+WT-ADA achieved satisfactory results in terms of five-day Crude Oil price forecast.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)