Summary

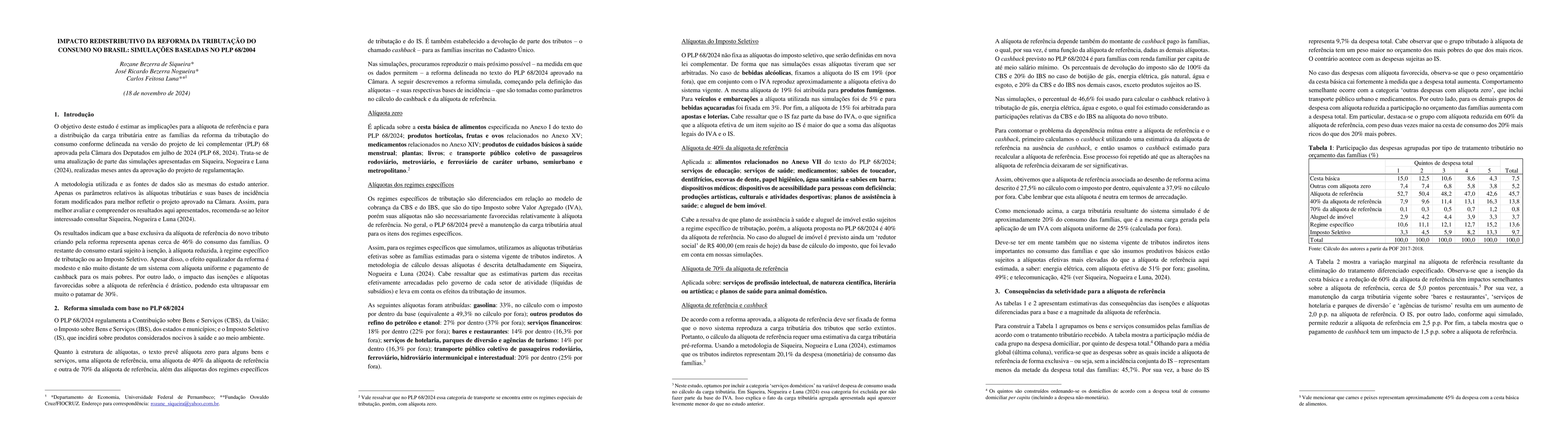

The aim of this study is to estimate the implications for the reference rate and for the distribution of the tax burden among households from the consumption tax reform as outlined in the version of the Projeto de Lei Complementar (PLP) 68 approved by the Brazilian Chamber of Deputies in July 2024.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersImpacto Distributivo Potencial de Reformas na Tributacao Indireta no Brasil: Simulacoes Baseadas na PEC 45/2019

Rozane Bezerra dde Siqueira, Jose Ricardo Bezerra Nogueira, Carlos Feitosa Luna

[Telehealth: a digital strategy for demand management in primary health care facilities in ChileTelessaúde: uma estratégia digital para a gestão da demanda na atenção primária à saúde no Chile].

González, Cristian, Guajardo, Hernán, Martínez, María Soledad et al.

No citations found for this paper.

Comments (0)