Authors

Summary

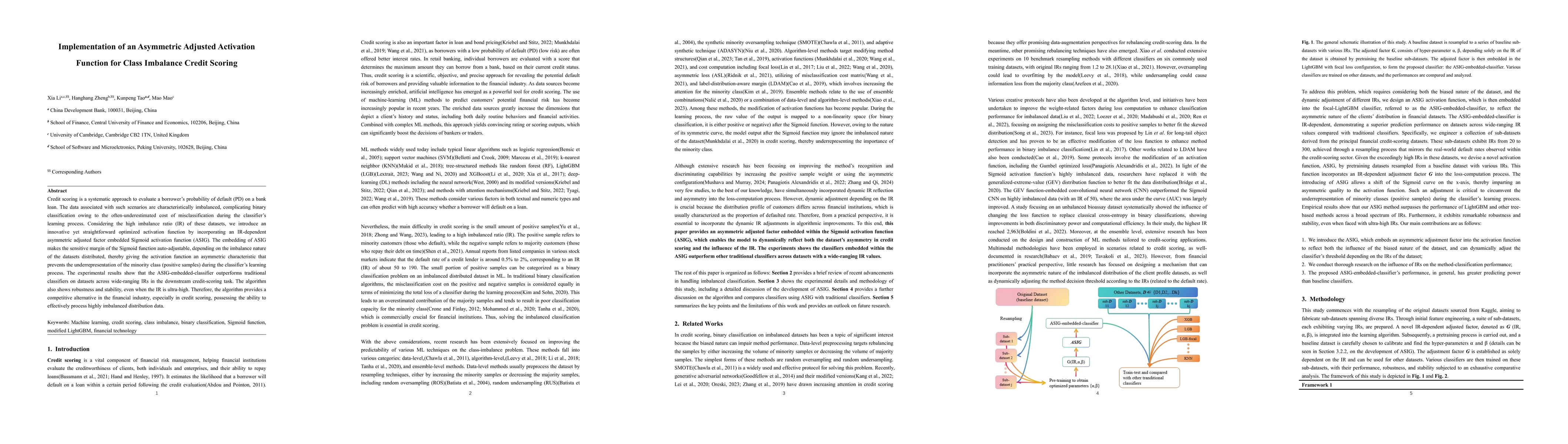

Credit scoring is a systematic approach to evaluate a borrower's probability of default (PD) on a bank loan. The data associated with such scenarios are characteristically imbalanced, complicating binary classification owing to the often-underestimated cost of misclassification during the classifier's learning process. Considering the high imbalance ratio (IR) of these datasets, we introduce an innovative yet straightforward optimized activation function by incorporating an IR-dependent asymmetric adjusted factor embedded Sigmoid activation function (ASIG). The embedding of ASIG makes the sensitive margin of the Sigmoid function auto-adjustable, depending on the imbalance nature of the datasets distributed, thereby giving the activation function an asymmetric characteristic that prevents the underrepresentation of the minority class (positive samples) during the classifier's learning process. The experimental results show that the ASIG-embedded-classifier outperforms traditional classifiers on datasets across wide-ranging IRs in the downstream credit-scoring task. The algorithm also shows robustness and stability, even when the IR is ultra-high. Therefore, the algorithm provides a competitive alternative in the financial industry, especially in credit scoring, possessing the ability to effectively process highly imbalanced distribution data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersClass-Imbalanced-Aware Adaptive Dataset Distillation for Scalable Pretrained Model on Credit Scoring

Hong Liu, Xiao Chen, Xia Li et al.

Fairness in Credit Scoring: Assessment, Implementation and Profit Implications

Nikita Kozodoi, Stefan Lessmann, Johannes Jacob

No citations found for this paper.

Comments (0)