Summary

The implied volatility surface (IVS) is a fundamental building block in computational finance. We provide a survey of methodologies for constructing such surfaces. We also discuss various topics which can influence the successful construction of IVS in practice: arbitrage-free conditions in both strike and time, how to perform extrapolation outside the core region, choice of calibrating functional and selection of numerical optimization algorithms, volatility surface dynamics and asymptotics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

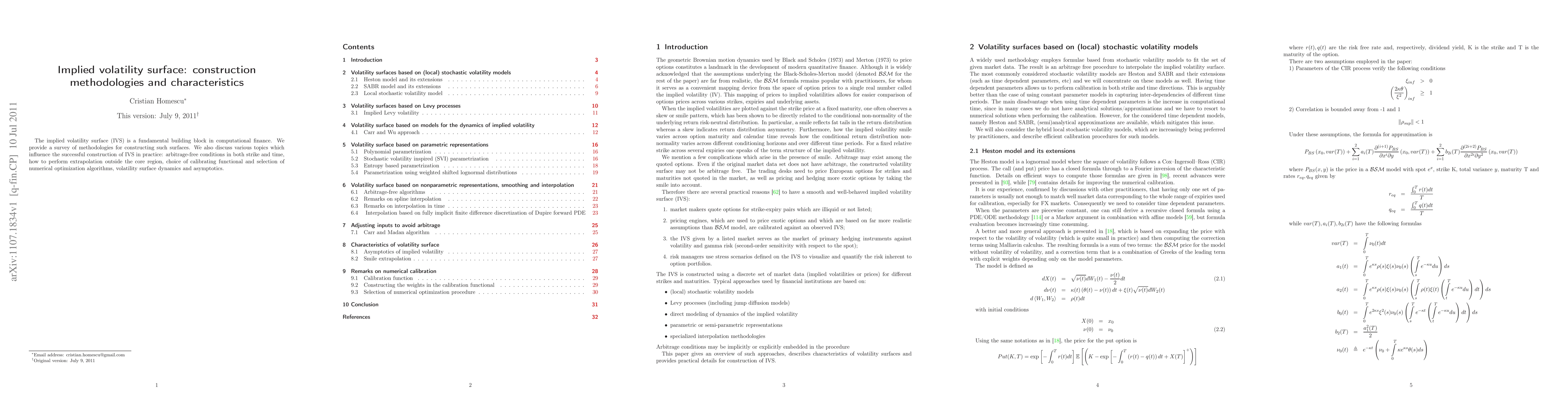

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDegree of Irrationality: Sentiment and Implied Volatility Surface

Yan Xie, Jiahao Weng

A Two-Step Framework for Arbitrage-Free Prediction of the Implied Volatility Surface

Gongqiu Zhang, Wenyong Zhang, Lingfei Li

| Title | Authors | Year | Actions |

|---|

Comments (0)