Authors

Summary

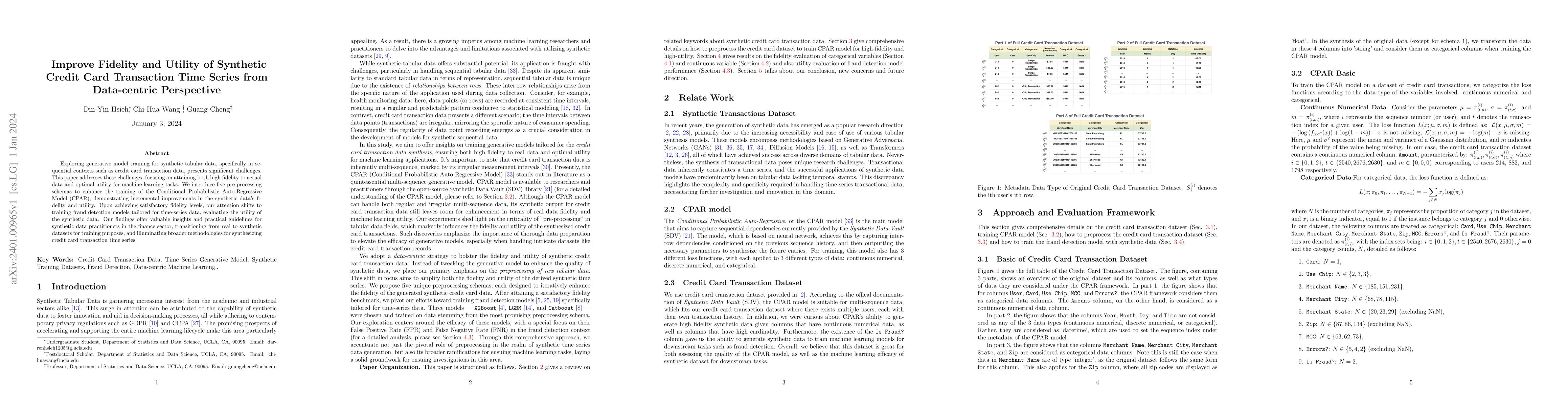

Exploring generative model training for synthetic tabular data, specifically in sequential contexts such as credit card transaction data, presents significant challenges. This paper addresses these challenges, focusing on attaining both high fidelity to actual data and optimal utility for machine learning tasks. We introduce five pre-processing schemas to enhance the training of the Conditional Probabilistic Auto-Regressive Model (CPAR), demonstrating incremental improvements in the synthetic data's fidelity and utility. Upon achieving satisfactory fidelity levels, our attention shifts to training fraud detection models tailored for time-series data, evaluating the utility of the synthetic data. Our findings offer valuable insights and practical guidelines for synthetic data practitioners in the finance sector, transitioning from real to synthetic datasets for training purposes, and illuminating broader methodologies for synthesizing credit card transaction time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)