Summary

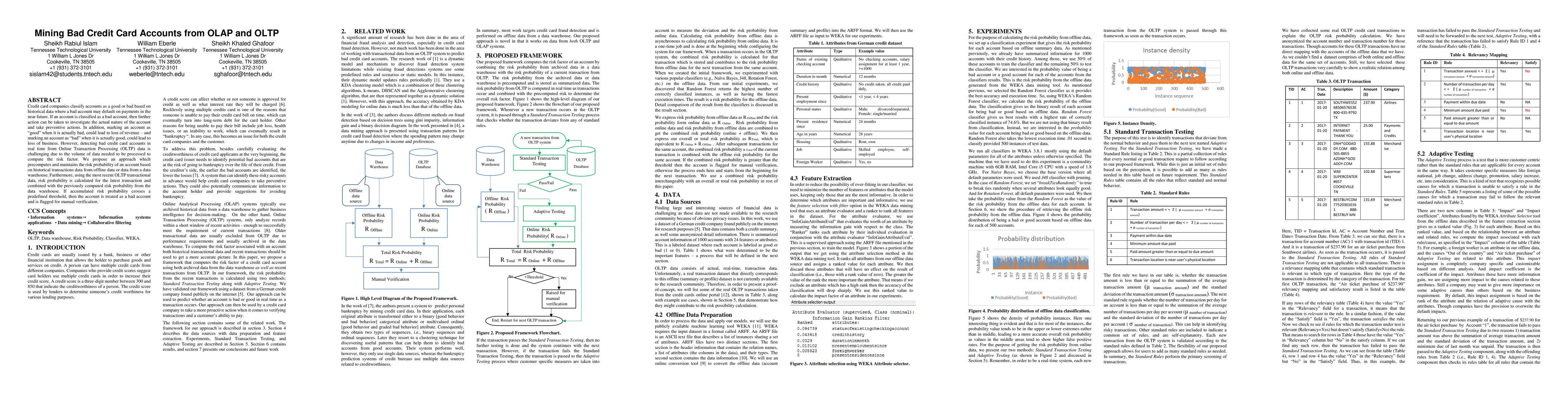

Credit card companies classify accounts as a good or bad based on historical data where a bad account may default on payments in the near future. If an account is classified as a bad account, then further action can be taken to investigate the actual nature of the account and take preventive actions. In addition, marking an account as "good" when it is actually bad, could lead to loss of revenue - and marking an account as "bad" when it is actually good, could lead to loss of business. However, detecting bad credit card accounts in real time from Online Transaction Processing (OLTP) data is challenging due to the volume of data needed to be processed to compute the risk factor. We propose an approach which precomputes and maintains the risk probability of an account based on historical transactions data from offline data or data from a data warehouse. Furthermore, using the most recent OLTP transactional data, risk probability is calculated for the latest transaction and combined with the previously computed risk probability from the data warehouse. If accumulated risk probability crosses a predefined threshold, then the account is treated as a bad account and is flagged for manual verification.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

| Title | Authors | Year | Actions |

|---|

Comments (0)