Summary

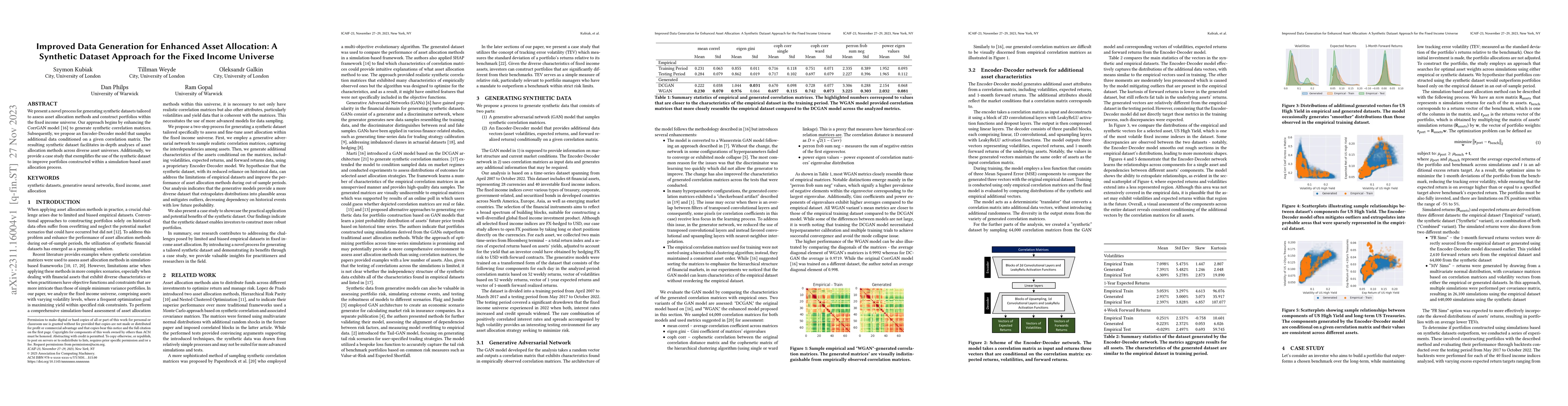

We present a novel process for generating synthetic datasets tailored to assess asset allocation methods and construct portfolios within the fixed income universe. Our approach begins by enhancing the CorrGAN model to generate synthetic correlation matrices. Subsequently, we propose an Encoder-Decoder model that samples additional data conditioned on a given correlation matrix. The resulting synthetic dataset facilitates in-depth analyses of asset allocation methods across diverse asset universes. Additionally, we provide a case study that exemplifies the use of the synthetic dataset to improve portfolios constructed within a simulation-based asset allocation process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Modified CTGAN-Plus-Features Based Method for Optimal Asset Allocation

José-Manuel Peña, Fernando Suárez, Omar Larré et al.

Synthetic Data Generation with LLM for Improved Depression Prediction

Jun Yu Chen, Andrea Kang, Zoe Lee-Youngzie et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)