Summary

We study computational problems in financial networks of banks connected by debt contracts and credit default swaps (CDSs). A main problem is to determine \emph{clearing} payments, for instance right after some banks have been exposed to a financial shock. Previous works have shown the $\varepsilon$-approximate version of the problem to be $\mathrm{PPAD}$-complete and the exact problem $\mathrm{FIXP}$-complete. We show that $\mathrm{PPAD}$-hardness hold when $\varepsilon \approx 0.101$, improving the previously best bound significantly. Due to the fact that the clearing problem typically does not have a unique solution, or that it may not have a solution at all in the presence of default costs, several natural decision problems are also of great interest. We show two such problems to be $\exists\mathbb{R}$-complete, complementing previous $\mathrm{NP}$-hardness results for the approximate setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

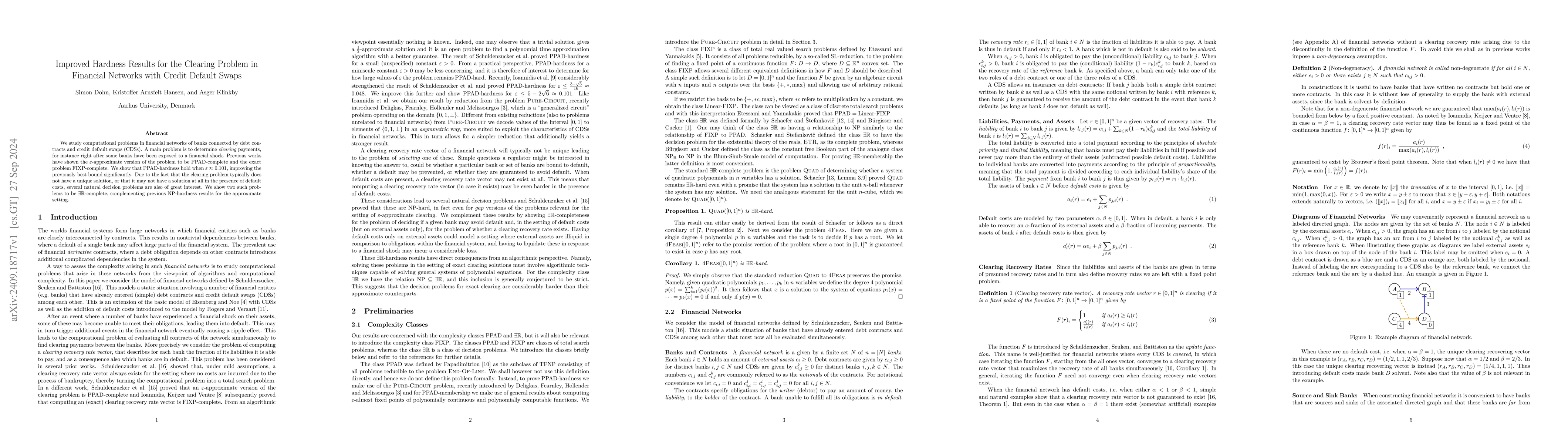

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersClearing Financial Networks with Derivatives: From Intractability to Algorithms

Carmine Ventre, Bart de Keijzer, Stavros D. Ioannidis

No citations found for this paper.

Comments (0)