Summary

Decision analytics commonly focuses on the text mining of financial news sources in order to provide managerial decision support and to predict stock market movements. Existing predictive frameworks almost exclusively apply traditional machine learning methods, whereas recent research indicates that traditional machine learning methods are not sufficiently capable of extracting suitable features and capturing the non-linear nature of complex tasks. As a remedy, novel deep learning models aim to overcome this issue by extending traditional neural network models with additional hidden layers. Indeed, deep learning has been shown to outperform traditional methods in terms of predictive performance. In this paper, we adapt the novel deep learning technique to financial decision support. In this instance, we aim to predict the direction of stock movements following financial disclosures. As a result, we show how deep learning can outperform the accuracy of random forests as a benchmark for machine learning by 5.66%.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

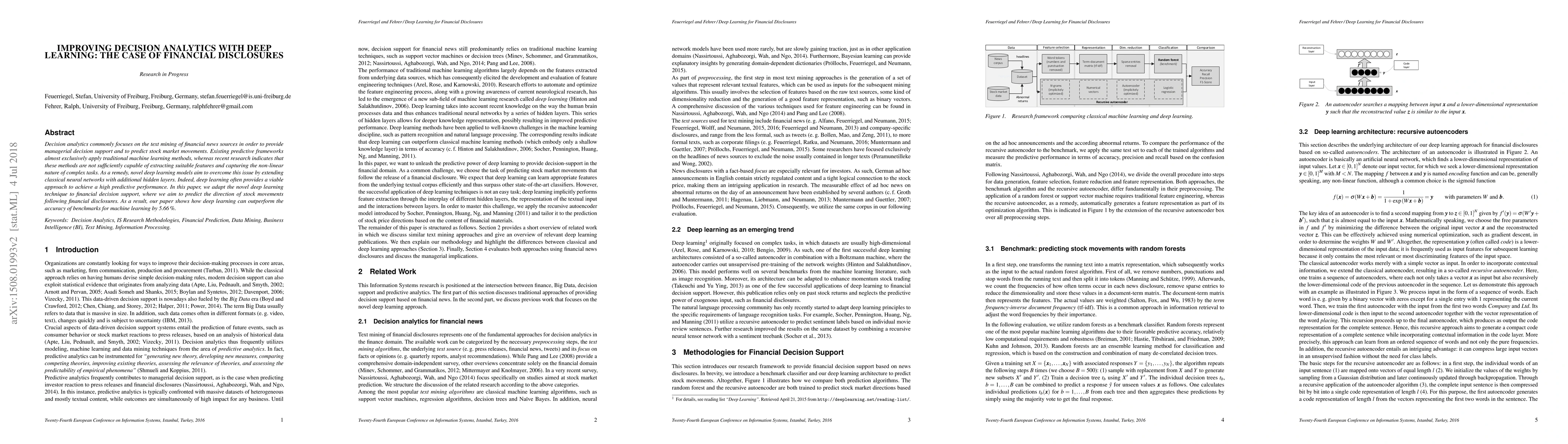

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)