Summary

Financial disclosure analysis and Knowledge extraction is an important financial analysis problem. Prevailing methods depend predominantly on quantitative ratios and techniques, which suffer from limitations like window dressing and past focus. Most of the information in a firm's financial disclosures is in unstructured text and contains valuable information about its health. Humans and machines fail to analyze it satisfactorily due to the enormous volume and unstructured nature, respectively. Researchers have started analyzing text content in disclosures recently. This paper covers the previous work in unstructured data analysis in Finance and Accounting. It also explores the state of art methods in computational linguistics and reviews the current methodologies in Natural Language Processing (NLP). Specifically, it focuses on research related to text source, linguistic attributes, firm attributes, and mathematical models employed in the text analysis approach. This work contributes to disclosure analysis methods by highlighting the limitations of the current focus on sentiment metrics and highlighting broader future research areas

AI Key Findings

Generated Sep 07, 2025

Methodology

The paper reviews existing literature on text analysis in financial disclosures, covering unstructured data analysis in finance and accounting, computational linguistics, and NLP methodologies. It focuses on text sources, linguistic attributes, firm attributes, and mathematical models in text analysis approaches.

Key Results

- Prevailing financial analysis methods rely heavily on quantitative ratios, which can be misleading due to issues like window dressing.

- Unstructured text in financial disclosures contains valuable information about a firm's health, but is often overlooked due to its volume and complexity.

- Sentiment analysis in financial disclosures has limitations, as it may result in significant information loss due to the asymmetric implications of positive and negative sentiment for investors.

- Both positive and negative sentiment measures explain variations in stock prices and trading volumes at the time of disclosure, as well as having predictive power for future profitability, cash holdings, and leverage.

- Firms with conservative disclosure tone are known to be risk-averse in M&A actions.

Significance

This research is important as it highlights the limitations of current sentiment-focused financial disclosure analysis methods and suggests broader future research areas, aiming to improve the extraction and utilization of valuable information from unstructured financial text data.

Technical Contribution

The paper contributes to disclosure analysis methods by providing a thorough review of existing literature on text analysis in financial disclosures, covering various aspects like text sources, linguistic attributes, firm attributes, and mathematical models.

Novelty

While the paper does not present original research, its value lies in consolidating and synthesizing existing research on text analysis in financial disclosures, identifying gaps, and suggesting future research directions.

Limitations

- The paper does not provide empirical evidence from original research but rather a comprehensive review of existing literature.

- The analysis is limited to the content presented in the reviewed papers and does not introduce new data or findings.

Future Work

- Explore advanced NLP techniques, such as transformer-based models, for improved text analysis in financial disclosures.

- Investigate the impact of multilingual financial disclosures on text analysis methods and outcomes.

Paper Details

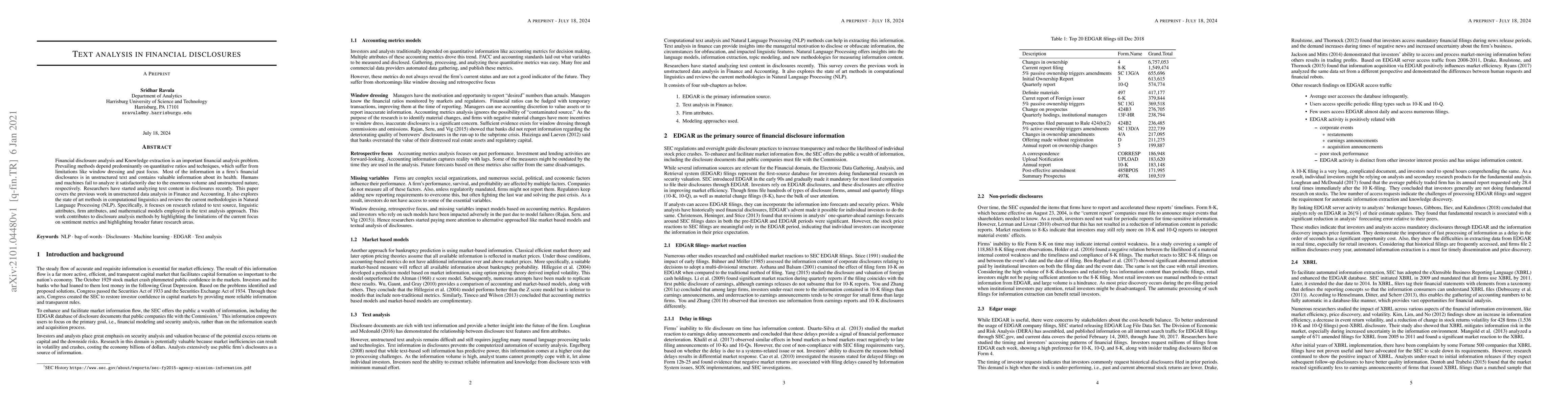

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEvaluating TCFD Reporting: A New Application of Zero-Shot Analysis to Climate-Related Financial Disclosures

David Lenz, Alix Auzepy, Elena Tönjes et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)