Summary

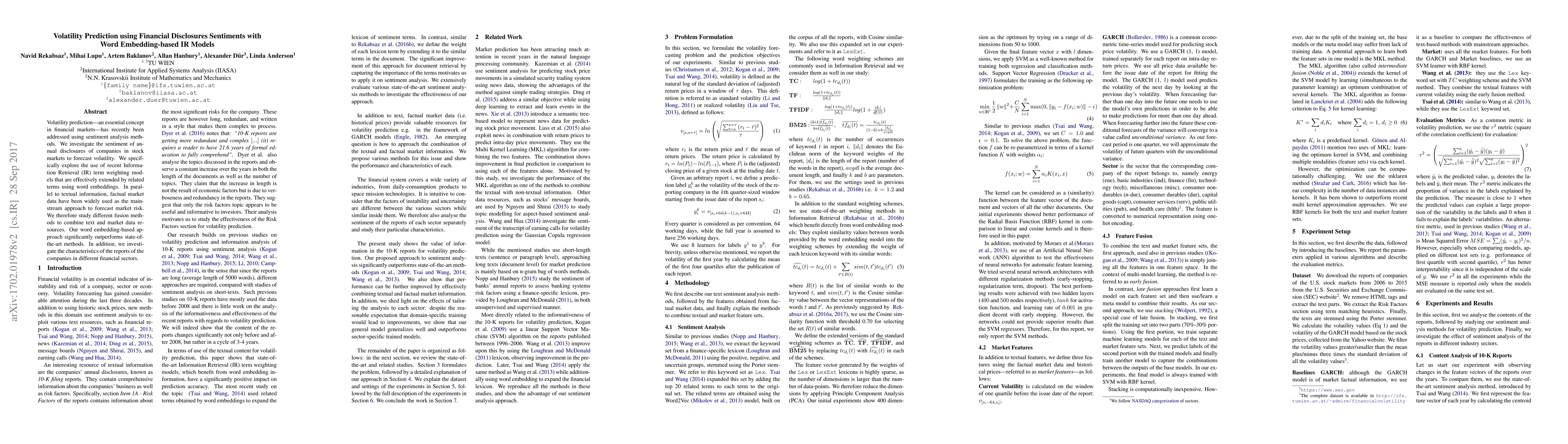

Volatility prediction--an essential concept in financial markets--has recently been addressed using sentiment analysis methods. We investigate the sentiment of annual disclosures of companies in stock markets to forecast volatility. We specifically explore the use of recent Information Retrieval (IR) term weighting models that are effectively extended by related terms using word embeddings. In parallel to textual information, factual market data have been widely used as the mainstream approach to forecast market risk. We therefore study different fusion methods to combine text and market data resources. Our word embedding-based approach significantly outperforms state-of-the-art methods. In addition, we investigate the characteristics of the reports of the companies in different financial sectors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRealised Volatility Forecasting: Machine Learning via Financial Word Embedding

Stefan Zohren, Eghbal Rahimikia, Ser-Huang Poon

Cubic-based Prediction Approach for Large Volatility Matrix using High-Frequency Financial Data

Donggyu Kim, Sung Hoon Choi

| Title | Authors | Year | Actions |

|---|

Comments (0)