Summary

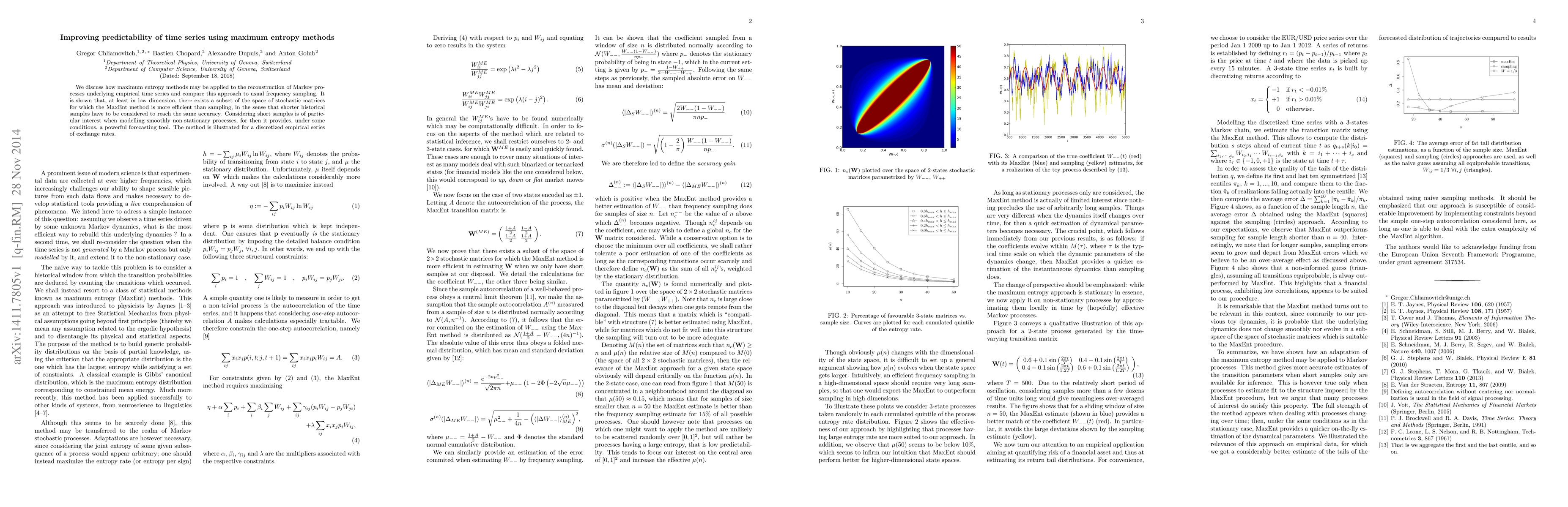

We discuss how maximum entropy methods may be applied to the reconstruction of Markov processes underlying empirical time series and compare this approach to usual frequency sampling. It is shown that, at least in low dimension, there exists a subset of the space of stochastic matrices for which the MaxEnt method is more efficient than sampling, in the sense that shorter historical samples have to be considered to reach the same accuracy. Considering short samples is of particular interest when modelling smoothly non-stationary processes, for then it provides, under some conditions, a powerful forecasting tool. The method is illustrated for a discretized empirical series of exchange rates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEquivalence between Time Series Predictability and Bayes Error Rate

Bin Guo, Zhiwen Yu, Tao Zhou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)