Summary

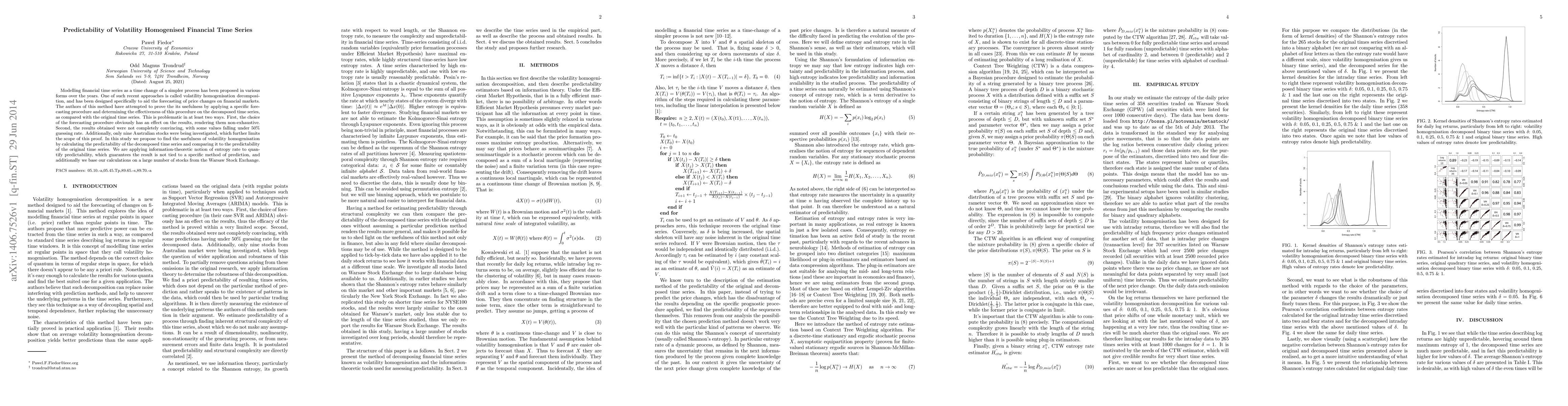

Modelling financial time series as a time change of a simpler process has been proposed in various forms over the years. One of such recent approaches is called volatility homogenisation decomposition, and has been designed specifically to aid the forecasting of price changes on financial markets. The authors of this method have attempted to prove the its usefulness by applying a specific forecasting procedure and determining the effectiveness of this procedure on the decomposed time series, as compared with the original time series. This is problematic in at least two ways. First, the choice of the forecasting procedure obviously has an effect on the results, rendering them non-exhaustive. Second, the results obtained were not completely convincing, with some values falling under 50% guessing rate. Additionally, only nine Australian stocks were being investigated, which further limits the scope of this proof. In this study we propose to find the usefulness of volatility homogenisation by calculating the predictability of the decomposed time series and comparing it to the predictability of the original time series. We are applying information-theoretic notion of entropy rate to quantify predictability, which guarantees the result is not tied to a specific method of prediction, and additionally we base our calculations on a large number of stocks from the Warsaw Stock Exchange.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)