Summary

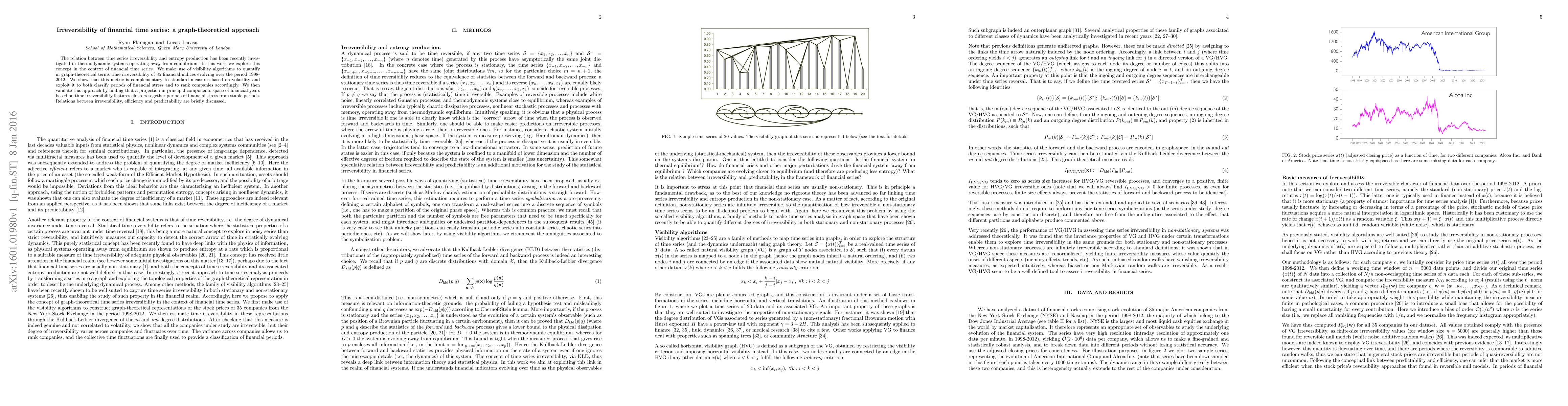

The relation between time series irreversibility and entropy production has been recently investigated in thermodynamic systems operating away from equilibrium. In this work we explore this concept in the context of financial time series. We make use of visibility algorithms to quantify in graph-theoretical terms time irreversibility of 35 financial indices evolving over the period 1998-2012. We show that this metric is complementary to standard measures based on volatility and exploit it to both classify periods of financial stress and to rank companies accordingly. We then validate this approach by finding that a projection in principal components space of financial years based on time irreversibility features clusters together periods of financial stress from stable periods. Relations between irreversibility, efficiency and predictability are briefly discussed.

AI Key Findings

Generated Sep 02, 2025

Methodology

The study uses visibility algorithms to quantify, in graph-theoretical terms, the time irreversibility of 35 financial indices over the period 1998-2012. It exploits this metric to classify periods of financial stress and rank companies accordingly.

Key Results

- The metric of time irreversibility is shown to be complementary to standard measures based on volatility.

- Periods of financial stress cluster together in principal components space when projected based on time irreversibility features.

Significance

This research provides a novel graph-theoretical approach to analyze financial time series irreversibility, which can be used to classify financial stress periods and rank companies, offering new insights into financial system efficiency and predictability.

Technical Contribution

The paper introduces a graph-theoretical measure (IHVG/VG) to quantify time series irreversibility in non-stationary financial time series, which is shown to be effective in distinguishing periods of financial stress.

Novelty

The novelty of this work lies in its application of visibility graph algorithms to financial time series analysis, providing a new perspective on financial system efficiency and stress detection.

Limitations

- The study does not discuss potential limitations in the dataset or methodology in detail.

- Generalizability to other markets or time periods is not explicitly addressed.

Future Work

- Further research could explore the relation between irreversibility, efficiency, and predictability in more detail.

- Investigating the applicability of this method to other financial datasets and markets could be beneficial.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIrreversibility of symbolic time series: a cautionary tale

Lucas Lacasa, Lluis Arola-Fernandez

Functional Decomposition and Estimation of Irreversibility in Time Series via Machine Learning

Michele Vodret, Christian Bongiorno, Cristiano Pacini

| Title | Authors | Year | Actions |

|---|

Comments (0)