Summary

This work introduces a novel, simple, and flexible method to quantify irreversibility in generic high-dimensional time series based on the well-known mapping to a binary classification problem. Our approach utilizes gradient boosting for estimation, providing a model-free, nonlinear analysis able to handle large-dimensional systems while requiring minimal or no calibration. Our procedure is divided into three phases: trajectory encoding, Markovian order identification, and hypothesis testing for variable interactions. The latter is the key innovation that allows us to selectively switch off variable interactions to discern their specific contribution to irreversibility. When applied to financial markets, our findings reveal a distinctive shift: during stable periods, irreversibility is mainly related to short-term patterns, whereas in unstable periods, these short-term patterns are disrupted, leaving only contributions from stable long-term ones. This observed transition underscores the crucial importance of high-order variable interactions in understanding the dynamics of financial markets, especially in times of turbulence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

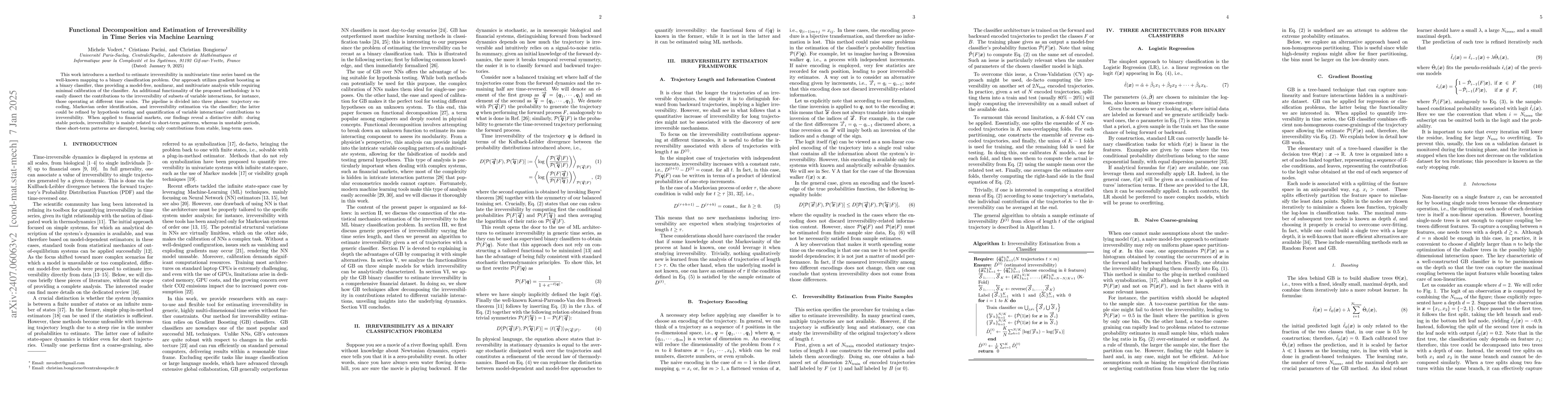

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIrreversibility of symbolic time series: a cautionary tale

Lucas Lacasa, Lluis Arola-Fernandez

Yule-Walker Estimation for Functional Time Series in Hilbert Space

Christina Dan Wang, Yuwei Zhao, Zhao Chen et al.

No citations found for this paper.

Comments (0)