Summary

The autocorrelation function of volatility in financial time series is fitted well by a superposition of several exponents. Such a case admits an explicit analytical solution of the problem of constructing the best linear forecast of a stationary stochastic process. We describe and apply the proposed analytical method for forecasting volatility. The leverage effect and volatility clustering are taken into account. Parameters of the predictor function are determined numerically for the Dow Jones 30 Industrial Average. Connection of the proposed method to the popular ARCH models is discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

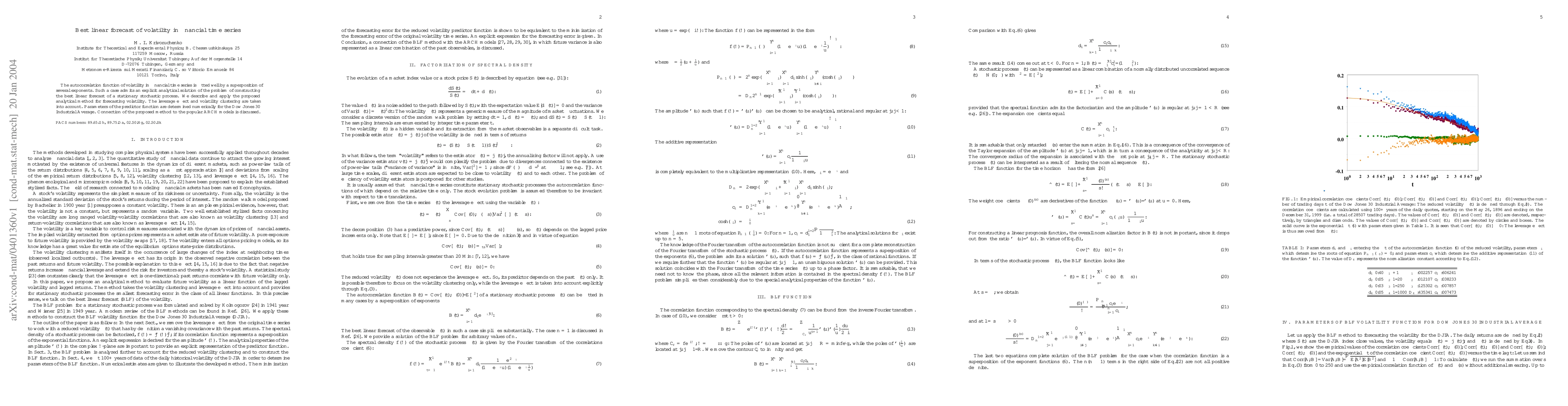

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)