Summary

In this paper, non-linear time series models are used to describe volatility in financial time series data. To describe volatility, two of the non-linear time series are combined into form TAR (Threshold Auto-Regressive Model) with AARCH (Asymmetric Auto-Regressive Conditional Heteroskedasticity) error term and its parameter estimation is studied.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

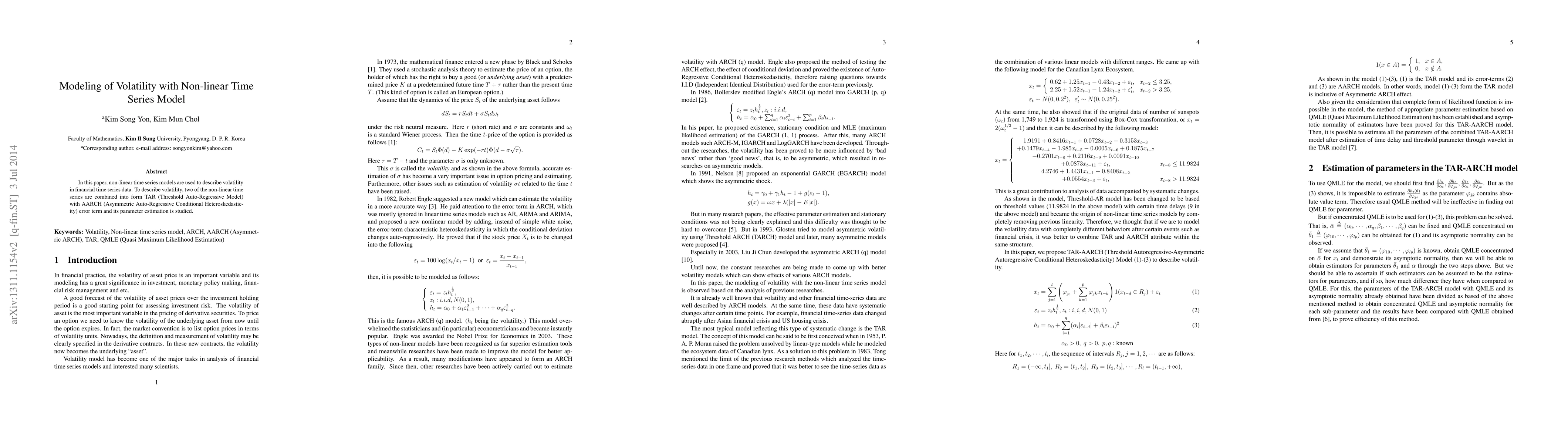

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling Latent Non-Linear Dynamical System over Time Series

Yasuko Matsubara, Yasushi Sakurai, Ren Fujiwara

No citations found for this paper.

Comments (0)