Authors

Summary

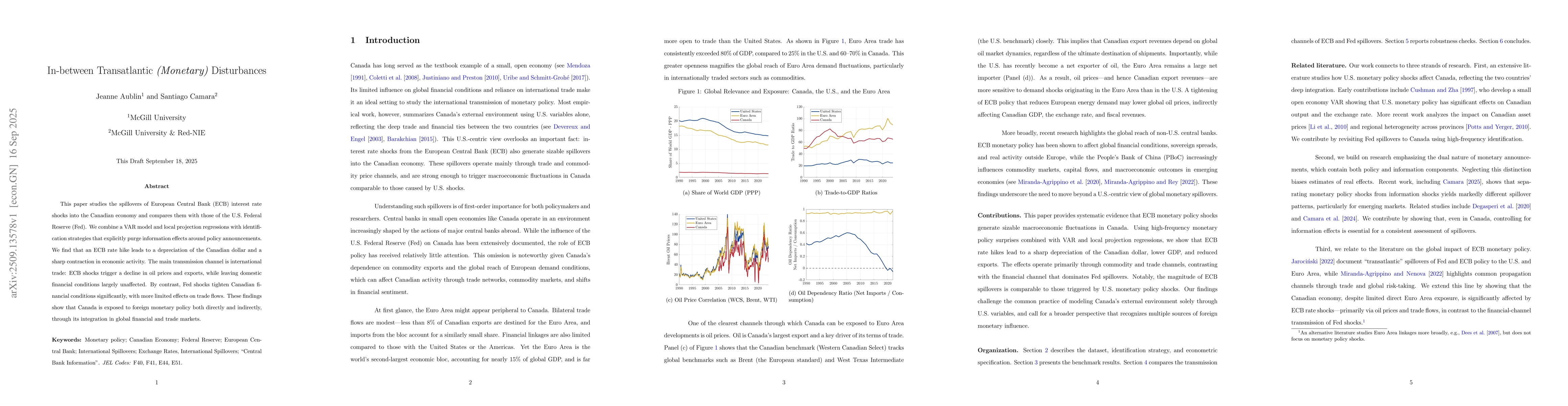

This paper studies the spillovers of European Central Bank (ECB) interest rate shocks into the Canadian economy and compares them with those of the U.S. Federal Reserve (Fed). We combine a VAR model and local projection regressions with identification strategies that explicitly purge information effects around policy announcements. We find that an ECB rate hike leads to a depreciation of the Canadian dollar and a sharp contraction in economic activity. The main transmission channel is international trade: ECB shocks trigger a decline in oil prices and exports, while leaving domestic financial conditions largely unaffected. By contrast, Fed shocks tighten Canadian financial conditions significantly, with more limited effects on trade flows. These findings show that Canada is exposed to foreign monetary policy both directly and indirectly, through its integration in global financial and trade markets.

AI Key Findings

Generated Sep 22, 2025

Methodology

The study combines a VAR model and local projection regressions with identification strategies that explicitly purge information effects around policy announcements to analyze spillovers of ECB and Fed interest rate shocks into the Canadian economy.

Key Results

- ECB rate hikes lead to Canadian dollar depreciation and economic contraction primarily through global commodity demand and trade channels, especially oil prices and exports.

- Fed shocks tighten Canadian financial conditions significantly, affecting interest rates, housing prices, and credit markets with more limited trade flow impacts.

- ECB shocks transmit mainly through real activity and trade, while Fed shocks operate through financial conditions, highlighting asymmetric transmission mechanisms.

Significance

This research provides critical insights into how Canada's economy is influenced by foreign monetary policies, emphasizing the dual exposure to European and U.S. policy shocks through trade and financial channels, which has implications for both academic research and monetary policy formulation.

Technical Contribution

The paper introduces a robust identification strategy that separates pure monetary policy shocks from information effects, enhancing the accuracy of spillover analysis.

Novelty

This work is novel in its comprehensive comparison of ECB and Fed spillovers into Canada, highlighting distinct transmission channels and the asymmetric impact of foreign monetary policy shocks.

Limitations

- Results may be influenced by unaccounted information effects in monetary policy announcements.

- The analysis excludes the COVID-19 period, which could affect the generality of findings.

Future Work

- Investigate whether similar asymmetries characterize exposure of other small open economies.

- Explore how domestic monetary frameworks can better incorporate global monetary transmission mechanisms.

- Further examine the role of information effects in policy spillovers across different economic contexts.

Paper Details

PDF Preview

Similar Papers

Found 4 papersChina's Easily Overlooked Monetary Transmission Mechanism: Monetary Reservoir

Shuguang Xiao, Xinglin Lai, Jiamin Peng

Comments (0)