Authors

Summary

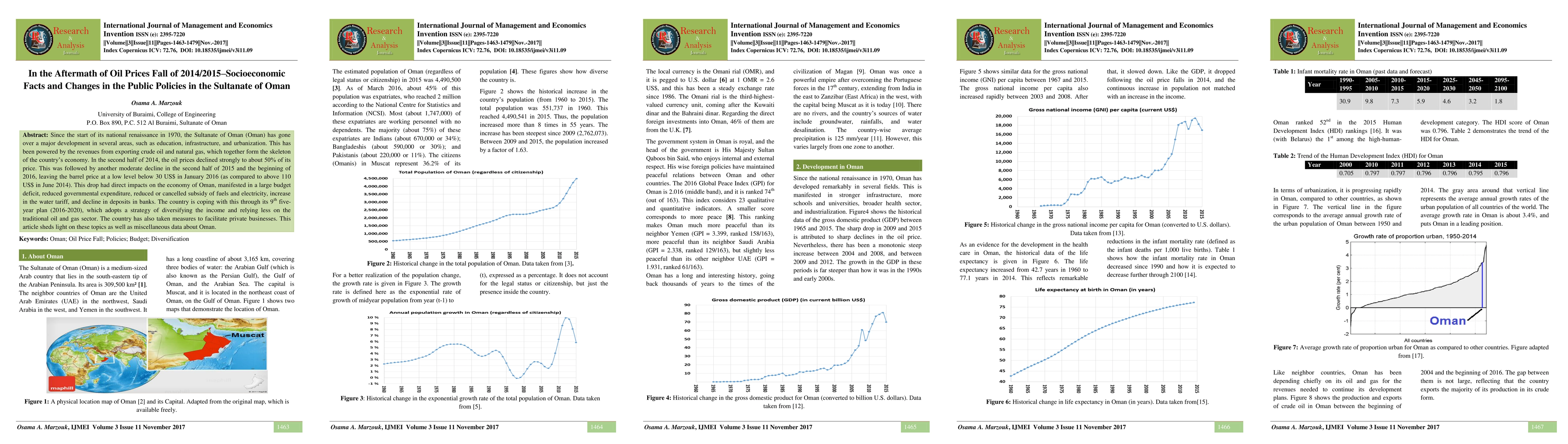

Since the start of its national renaissance in 1970, the Sultanate of Oman (Oman) has gone over a major development in several areas, such as education, infrastructure, and urbanization. This has been powered by the revenues from exporting crude oil and natural gas, which together form the skeleton of the country's economy. In the second half of 2014, the oil prices declined strongly to about 50% of its price. This was followed by another moderate decline in the second half of 2015 and the beginning of 2016, leaving the barrel price at a low level below 30 US$ in January 2016 (as compared to above 110 US$ in June 2014). This drop had direct impacts on the economy of Oman, manifested in a large budget deficit, reduced governmental expenditure, reduced or cancelled subsidy of fuels and electricity, increase in the water tariff, and decline in deposits in banks. The country is coping with this through its 9th five-year plan (2016-2020), which adopts a strategy of diversifying the income and relying less on the traditional oil and gas sector. The country has also taken measures to facilitate private businesses. This article sheds light on these topics as well as miscellaneous data about Oman.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProposed 2MW Wind Turbine for Use in the Governorate of Dhofar at the Sultanate of Oman

Osama Ahmed Marzouk, Omar Rashid Hamdan Al Badi, Maadh Hamed Salman Al Rashdi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)