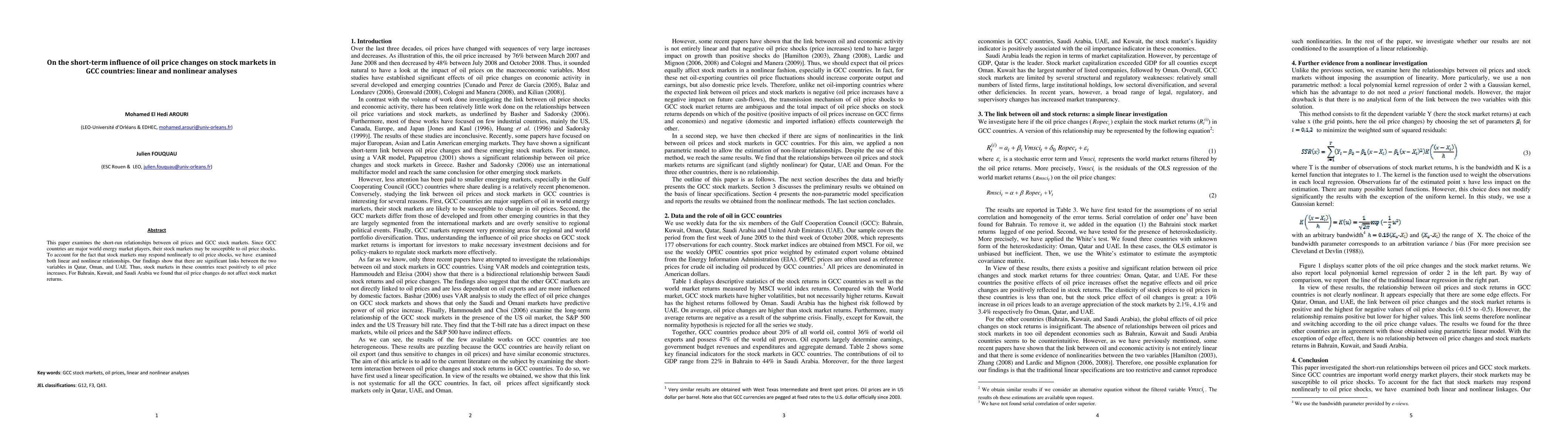

Summary

This paper examines the short-run relationships between oil prices and GCC stock markets. Since GCC countries are major world energy market players, their stock markets may be susceptible to oil price shocks. To account for the fact that stock markets may respond nonlinearly to oil price shocks, we have examined both linear and nonlinear relationships. Our findings show that there are significant links between the two variables in Qatar, Oman, and UAE. Thus, stock markets in these countries react positively to oil price increases. For Bahrain, Kuwait, and Saudi Arabia we found that oil price changes do not affect stock market returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersEconomic Diversification and Social Progress in the GCC Countries: A Study on the Transition from Oil-Dependency to Knowledge-Based Economies

Mahdi Goldani, Soraya Asadi Tirvan

LSR-IGRU: Stock Trend Prediction Based on Long Short-Term Relationships and Improved GRU

Yifan Hu, Qinyuan Liu, Peng Zhu et al.

Comments (0)