Summary

We consider a dynamic pricing problem for repeated contextual second-price auctions with multiple strategic buyers who aim to maximize their long-term time discounted utility. The seller has limited information on buyers' overall demand curves which depends on a non-parametric market-noise distribution, and buyers may potentially submit corrupted bids (relative to true valuations) to manipulate the seller's pricing policy for more favorable reserve prices in the future. We focus on designing the seller's learning policy to set contextual reserve prices where the seller's goal is to minimize regret compared to the revenue of a benchmark clairvoyant policy that has full information of buyers' demand. We propose a policy with a phased-structure that incorporates randomized "isolation" periods, during which a buyer is randomly chosen to solely participate in the auction. We show that this design allows the seller to control the number of periods in which buyers significantly corrupt their bids. We then prove that our policy enjoys a $T$-period regret of $\widetilde{\mathcal{O}}(\sqrt{T})$ facing strategic buyers. Finally, we conduct numerical simulations to compare our proposed algorithm to standard pricing policies. Our numerical results show that our algorithm outperforms these policies under various buyer bidding behavior.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

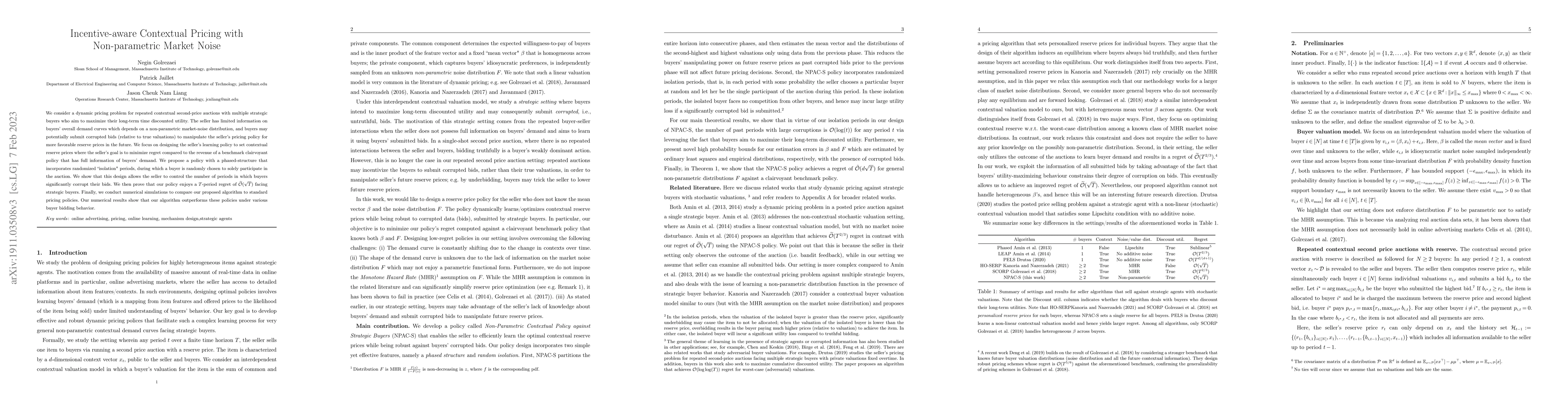

Similar Papers

Found 4 papersDynamic Contextual Pricing with Doubly Non-Parametric Random Utility Models

Xi Chen, Elynn Chen, Lan Gao et al.

Multi-Task Dynamic Pricing in Credit Market with Contextual Information

Adel Javanmard, Renyuan Xu, Jingwei Ji

| Title | Authors | Year | Actions |

|---|

Comments (0)