Summary

When banks extend loans to each other, they generate a negative externality in the form of systemic risk. They create a network of interbank exposures by which they expose other banks to potential insolvency cascades. In this paper, we show how a regulator can use information about the financial network to devise a transaction-specific tax based on a network centrality measure that captures systemic importance. Since different transactions have different impact on creating systemic risk, they are taxed differently. We call this tax a Systemic Risk Tax (SRT). We use an equilibrium concept inspired by the matching markets literature to show analytically that this SRT induces a unique equilibrium matching of lenders and borrowers that is systemic-risk efficient, i.e. it minimizes systemic risk given a certain transaction volume. On the other hand, we show that without this SRT multiple equilibrium matchings exist, which are generally inefficient. This allows the regulator to effectively stimulate a `rewiring' of the equilibrium interbank network so as to make it more resilient to insolvency cascades, without sacrificing transaction volume. Moreover, we show that a standard financial transaction tax (e.g. a Tobin-like tax) has no impact on reshaping the equilibrium financial network because it taxes all transactions indiscriminately. A Tobin-like tax is indeed shown to have a limited effect on reducing systemic risk while it decreases transaction volume.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

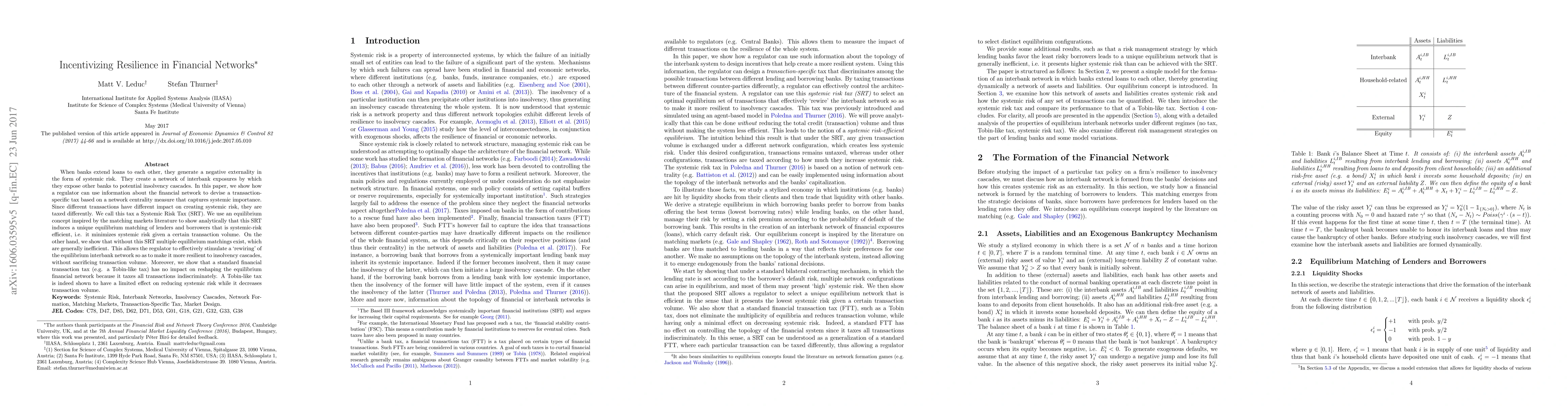

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWorkplace sustainability or financial resilience? Composite-financial resilience index

Elham Daadmehr

Default Resilience and Worst-Case Effects in Financial Networks

Giuseppe Calafiore, Giulia Fracastoro, Anton Proskurnikov

Measuring Financial Resilience Using Backward Stochastic Differential Equations

Emanuela Rosazza Gianin, Roger J. A. Laeven, Marco Zullino et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)