Authors

Summary

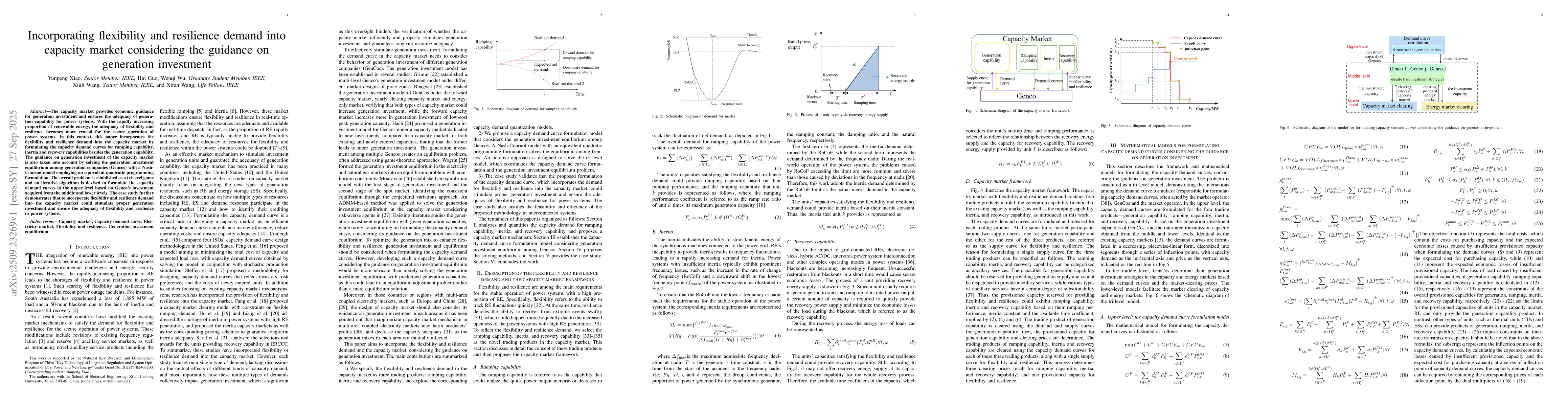

The capacity market provides economic guidance for generation investment and ensures the adequacy of generation capability for power systems. With the rapidly increasing proportion of renewable energy, the adequacy of flexibility and resilience becomes more crucial for the secure operation of power systems. In this context, this paper incorporates the flexibility and resilience demand into the capacity market by formulating the capacity demand curves for ramping capability, inertia and recovery capabilities besides the generation capability. The guidance on generation investment of the capacity market is also taken into account by solving the generation investment equilibrium among generation companies with a Nash Cournot model employing an equivalent quadratic programming formulation. The overall problem is established as a trilevel game and an iterative algorithm is devised to formulate the capacity demand curves in the upper level based on Genco's investment acquired from the middle and lower levels. The case study further demonstrates that to incorporate flexibility and resilience demand into the capacity market could stimulate proper generation investment and ensure the adequacy of flexibility and resilience in power systems.

AI Key Findings

Generated Oct 01, 2025

Methodology

The research employs a tri-level optimization model integrating capacity market design with generation investment equilibrium, using a Nash-Cournot framework and quadratic programming to address flexibility and resilience demands in power systems.

Key Results

- Incorporating flexibility and resilience demands into capacity markets effectively reflects resource scarcity/surplus and guides generation investment for adequacy.

- Capacity market purchasing costs increase, but expected economic losses from insufficient flexibility/resilience capabilities are significantly reduced.

- Formulating capacity demand curves separately for each region in interconnected systems leads to higher market costs but better regional resilience guarantees.

Significance

This research provides a framework for designing capacity markets that ensure power system adequacy in the face of increasing renewable energy penetration, addressing critical challenges in flexibility and resilience management.

Technical Contribution

Proposes a modified capacity market framework with tri-level optimization, combining generation investment equilibrium and demand curve formulation through a Nash-Cournot model with quadratic programming formulation.

Novelty

Introduces a systematic approach to integrate flexibility and resilience requirements into capacity market design, addressing both resource adequacy and economic efficiency in power systems with high renewable penetration.

Limitations

- Assumes perfect market participation and risk-neutral behavior which may not reflect real-world complexities

- Focuses on simplified system configurations that may not capture all regional interdependencies

Future Work

- Incorporate more realistic market participant behaviors and risk preferences

- Extend analysis to include multi-carrier energy systems and cross-border interactions

- Develop adaptive capacity market mechanisms for evolving renewable integration levels

Paper Details

PDF Preview

Similar Papers

Found 5 papersIndustrial Flexibility Investment Under Uncertainty: A Multi-Stage Stochastic Framework Considering Energy and Reserve Market Participation

Stian Backe, Amund Norland, Lasse Skare et al.

Incentivizing Investment and Reliability: A Study on Electricity Capacity Markets

Cheng Guo, Christian Kroer, Daniel Bienstock et al.

An advanced reliability reserve incentivizes flexibility investments while safeguarding the electricity market

Wolf-Peter Schill, Alexander Roth, Karsten Neuhoff et al.

Comments (0)