Summary

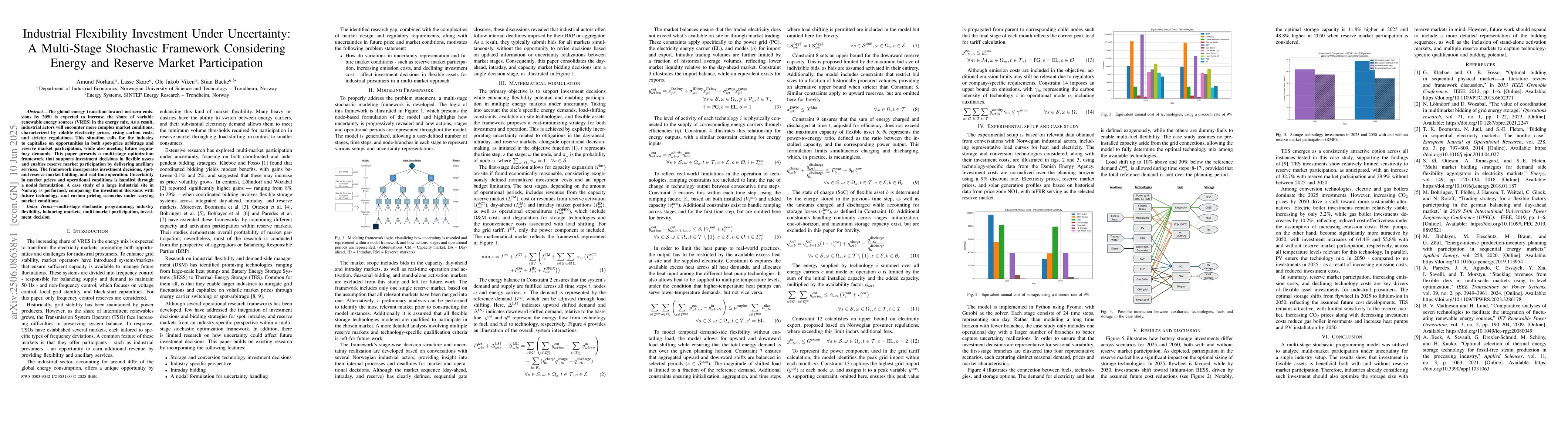

The global energy transition toward net-zero emissions by 2050 is expected to increase the share of variable renewable energy sources (VRES) in the energy mix. As a result, industrial actors will encounter more complex market conditions, characterized by volatile electricity prices, rising carbon costs, and stricter regulations. This situation calls for the industry to capitalize on opportunities in both spot-price arbitrage and reserve market participation, while also meeting future regulatory demands. This paper presents a multi-stage optimization framework that supports investment decisions in flexible assets and enables reserve market participation by delivering ancillary services. The framework incorporates investment decisions, spot- and reserve-market bidding, and real-time operation. Uncertainty in market prices and operational conditions is handled through a nodal formulation. A case study of a large industrial site in Norway is performed, comparing the investment decisions with future technology- and carbon pricing scenarios under varying market conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhere to Market Flexibility? Optimal Participation of Industrial Energy Systems in Balancing-Power, Day-Ahead, and Continuous Intraday Electricity Markets

Alissa Ganter, Ludger Leenders, André Bardow et al.

Techno-economic optimization of hybrid steam-electric energy systems with excess heat utilization and reserve market participation

Olav Galteland, Jacob Hadler-Jacobsen, Hanne Kauko

No citations found for this paper.

Comments (0)