Summary

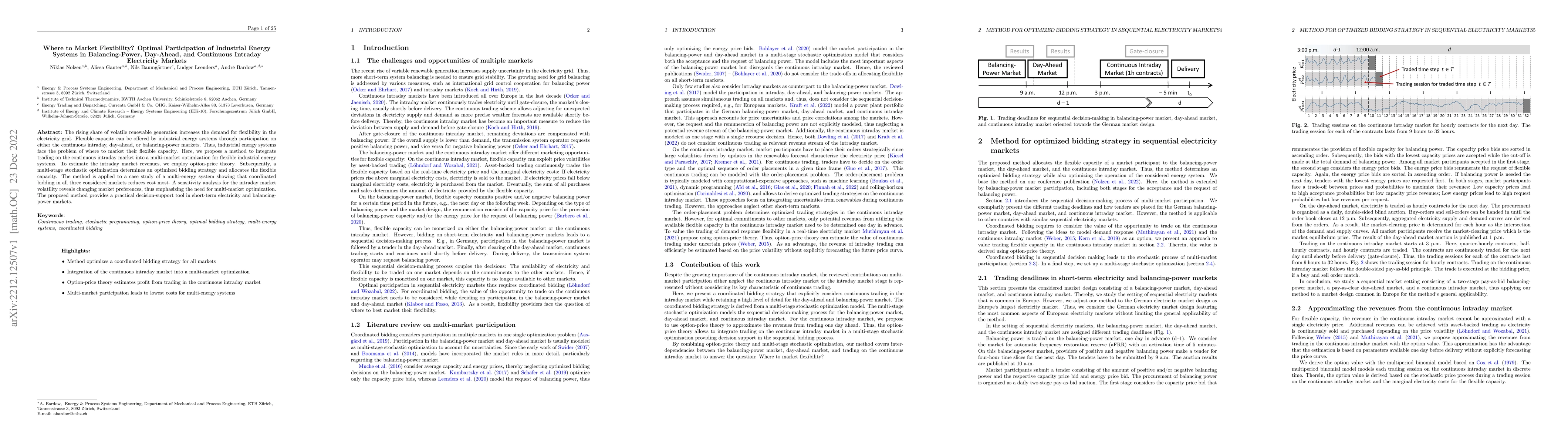

The rising share of volatile renewable generation increases the demand for flexibility in the electricity grid. Flexible capacity can be offered by industrial energy systems through participation on either the continuous intraday, day-ahead, or balancing-power markets. Thus, industrial energy systems face the problem of where to market their flexible capacity. Here, we propose a method to integrate trading on the continuous intraday market into a multi-market optimization for flexible industrial energy systems. To estimate the intraday market revenues, we employ option-price theory. Subsequently, a multi-stage stochastic optimization determines an optimized bidding strategy and allocates the flexible capacity. The method is applied to a case study of a multi-energy system showing that coordinated bidding in all three considered markets reduces cost most. A sensitivity analysis for the intraday market volatility reveals changing market preferences, thus emphasizing the need for multi-market optimization. The proposed method provides a practical decision-support tool in short-term electricity and balancing-power markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRolling intrinsic for battery valuation in day-ahead and intraday markets

Daniel Oeltz, Tobias Pfingsten

Nash Equilibrium of Joint Day-ahead Electricity Markets and Forward Contracts in Congested Power Systems

Henrik Madsen, Mohsen Banaei, Razgar Ebrahimy et al.

Optimizing the Marketing of Flexibility for a Virtual Battery in Day-Ahead and Balancing Markets: A Rolling Horizon Case Study

E. Finhold, C. Gärtner, R. Grindel et al.

Representative electricity price profiles for European day-ahead and intraday spot markets

Alexander Mitsos, Chrysanthi Papadimitriou, Jan C. Schulze

| Title | Authors | Year | Actions |

|---|

Comments (0)