Summary

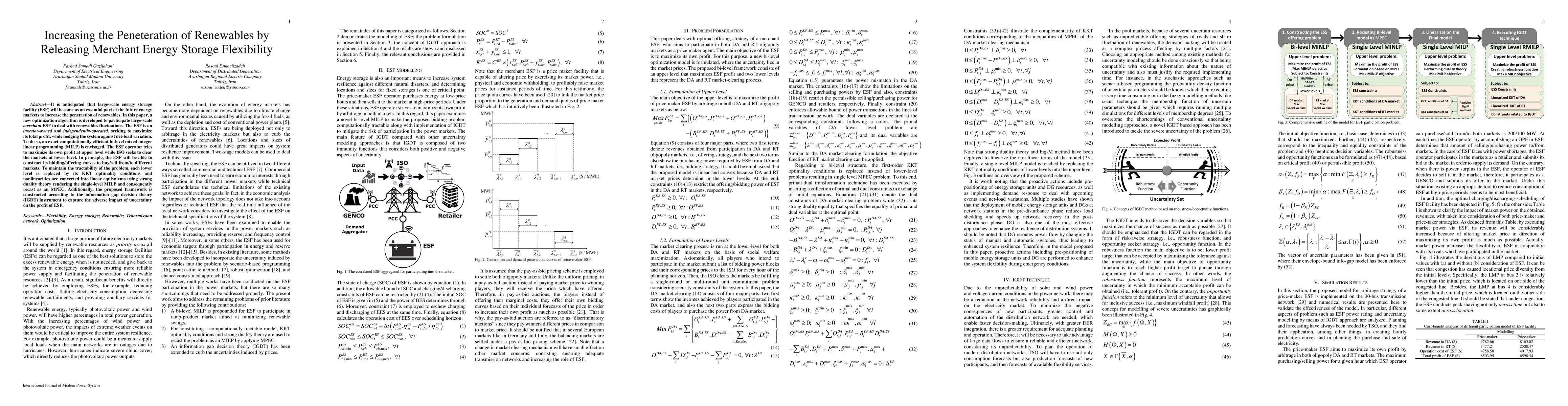

It is anticipated that large-scale energy storage facility (ESF) will become an essential part of the future energy markets to increase the penetration of renewables. In this paper, a new optimization algorithm is developed to participate in large-scale merchant ESF to deal with renewables fluctuations. The ESF is an investor-owned and independently-operated, seeking to maximize its total profit while hedging the system against net-load variation. To do so, an exact computationally efficient bi-level mixed-integer linear programming (MILP) is envisaged. The ESF operator tries to maximize its own profit at the upper level while ISO seeks to clear the markets at the lower level. In principle, the ESF will be able to construct its bidding/offering curves to buy/sell from/to different markets. To maintain the tractability of the problem, each lower level is replaced by its KKT optimality conditions, and nonlinearities are converted into linear equivalents using strong duality theory rendering the single-level MILP and consequently recast as an MPEC. Additionally, the proposed framework is constructed according to the information gap decision theory (IGDT) instrument to capture the adverse impact of uncertainty on the profit of ESF.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the Efficiency of Energy Markets with Non-Merchant Storage

Jalal Kazempour, Pierre Pinson, Linde Frölke et al.

Virtual Linking Bids for Market Clearing with Non-Merchant Storage

Eléa Prat, Jonas Bodulv Broge, Richard Lusby

| Title | Authors | Year | Actions |

|---|

Comments (0)